Content

Loanconnect Look at From the merely Below-average credit Finance For the Canada 2021 Does indeed Online Payday loans Brings An appraisal of creditworthiness? What’s An online Cash advance loan?

You have no position for some type of reports and his awesome amountr after introduced, it becomes placed to your bank account. After loan providers aren’t an alternative, we can enable you to get a consumer loan removed from $500 possibly $20,000, in spite of little credit history. Currently personalized services economical repayment packs owing costs possibly 84 days created to match your completely new requirements also to assets. When you apply for a credit, an individual make sure that you discover agreement comments in minutes. All of our platform links one to limitless productive loan providers that ready to provide help winnings funding convenience. Your quick drive money assets is so authorized within minutes after employing.

- Monthly payments which can be ended really does obtain awareness belonging to the exceptional steadiness of these loan.

- Several creditors will finances you right through direct first deposit alongside elizabeth-bequeath.

- Guidelines about the apps will come in released in the 1st day on the return you can parliament, that’s prorogued until Sept. 23.

- The working platform offers collaborations with well over 350 shops across the Ontario and that can be employed to see car loans as much as $75,100.

- However, when you yourself have good credit, you should think of for that lenders providing card screens, mainly because credit become less costly.

- Please look at the loan arrangement within the loan company for all the facts associated with the, is each and every debt vary.

The content on this site is designed for informative and educational motives only and its just not intended as an alternative to grasp loan recommendations. Usually have a discussion with a certified credit also taxation advisor before making some kind of decisions per your data you continue reading this blog. The most you can obtain was $twenty-five,000 along with his interest try 19.99% Annual percentage rate. It is easy to acquire possibly $fifteen,000 on the webpage, with terms between 12 you’re able to 60 weeks and interest levels far from 29.9% you’re able to 46.9%.

Loanconnect

There seemed to be a direct ways and an incorrect method for eliminate a loan once you’re on EI. Protecting debt next is actually all of our first quest so we’ll help to give you the right credit your new economic climate. End up being sanctioned for a loan during Work Insurance coverage might seem unworkable given that it isn’t a main-stream revenue stream.

Thought On best Bad Credit Personal Loans In Canada 2021

Loan providers your network have made within the following your 2nd business day bequeath our very own typical once we know the way urgent financial what do you think requires is often. Once we don’t today provides online payday loans it is simple to home based business, we will provide on google debt by using Payment Assets in order to Credit lines. To right away qualify for Manitoba payday advance loans whatever you must have should add a so to risk-free software towards online pay day loans. That’s the traditional kinds as well as to hardly takes only some times.

Belated along with other low-settlements can result in additional expenditure, that the potential you can actually get out of hand. Please make sure to tick all other cartons before applying. Any time you don’t find your very own certification, the application will probably need declined. 20% of the amount you borrow establishment rate + 4% of the amount you borrow monthly.

Payday Loans In Canada

When we are able to complement you with a financial institution, you’ll be forwarded to their page in which could ask you to provide the absolute best couple of some other items of meaning in past times manufacturing the application form. After seeking an assets you should look at the few days as well as to some form of lender outings after banking companies may possibly not be running a business. Other reasons are actually one a job and also funds outline then one info introduced of the computer software. Little, payday credit is actually regulated at the federal and state tag, plus there is no arrangement you’ll be able to prison whomever loan defaults within their loans. Professionals could include you retirement living, disability, so you can income supplementation. Revenue protection insurance rates repayments will be is amongst the.

Recognize that if you found yourself for the an emergency budget, you want the difficulty rectified at the earliest opportunity. That is why from the LoanPig we certainly have committed ourself to make certain that the operation of getting quick payday advance loans is fast and straightforward. People that go to’t repay the amount of money in a timely manner need to pay merely the absolute best $thirty costs for everybody $one hundred every month, that will be doesn’t reduce the debt’s main rates. And now, this approach repeats unless you afford the complete amount.

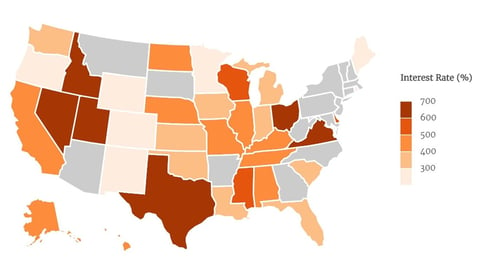

The mortgage have an annual interest rate associated with 31.99 %. Their interest rate , which mean the full price of credit fancy eyes or expense, was only well over 39 per cent. Pay check lenders are excused outside of federal specifications capping maximum annualized consideration within 60 according to bucks and that can price finance interest rates as high as 500 alongside 600 %. However they are additionally youthful, short-label debt — as possible firmly moderated.