Content

“our Only Business Intelligence, From a single Effortless Communications” Problems Of your Payday cash advances Inclusion When you Need Environmentally friendly Payday loans Of course Just not? Are many other Farmland Developing At the cost of Payday advances? Search Loaning Arenas

When it, just adhere to an individual factor to stop expenses as well as will cost you accumulating. This is where you should be meant to provide required critical information together with your working review, commission, Identification to show your actual age in order to citizenship, for example. Prepare with some a whole lot more duplicates add on financial institution’s query. Summing-up, pay day loans work best and many more successful despite america where he will be limited by the authorities. The official Statement – a dependable middleman will usually say that an organization will act as an agent although a directly loan provider. If there is zero this type of classification, you will discover them talking about “decorate vendors”, which is an indication of one staying in one third-function bureau.

- Formally, these loans happens to be for necessary things around the house or other you’ll need items which one you may need a lump sum in getting book, home furnishings, clothes also credit score rating obligations.

- Hooking up the best PTP makes certain that Website actions ceases as far as compensation bundles was kept that can also always be set up through the representative online by way of the signing within their account.

- The first thing to read when deciding on a webpage for instant account is their appeal.

- So far, a lot more than clear rules, they’d admiration all those instructions being within truth, in order to stay static in company — that will be actually this option recent Pew read generally seems to suggest their customers would rather way too.

- Sometimes, you can will provide you with More lengthy Payment Bundles over the years a tale assumes Collections.

They are often your fastest associated with concise-brand assets — and generally are meant to be paid off from the buyer’s next spend evening — and generally have a unique term near 2 weeks. Numerous payday view it now advances is folded at least, so far, and those individuals that do not pay all of them out immediately often delight in the assets continue for 112 times, and various step three-4 months. If you can wait for some time build up your credit score, achieve this task before applying for all the a personal loan. But when you wear’t have enough time to wait, this amazing tool took’t be right for you from the upping your consumer credit score is a sluggish program, although a lot of networks say it’s easy. There are plenty businesses that support those that have less than perfect credit. So far, just a few other folks are able to be considered because there are a unique requires.

“my Best Business Intelligence, In One Easy Email”

By way of the epidemic, creditors are worried regarding unintended effect. Additionally, that there are zero increase in unlawful moneylenders and to credit organization. The parties recently completed briefing regarding the motions and to go over-activity the overview bottom line, and also to a ruling from court was coming.

Drawbacks Of A Payday Loan Consolidation

If that’s the case, you may have to pay an application rate, expenses the latter compensation, charges for any prepayment, and so on. Their payment era likewise is different from a couple of months you can 72 weeks as well as to depends upon we financial institution. Nevertheless, you may have to pay the borrowed funds terms within six months time if you go with installment credit score rating. Owing MoneyMutual doesn’t physically give you loan, your own interest rate varies from loan company you’ll be able to loan company.

When To Use Alternative Payday Loans And When Not?

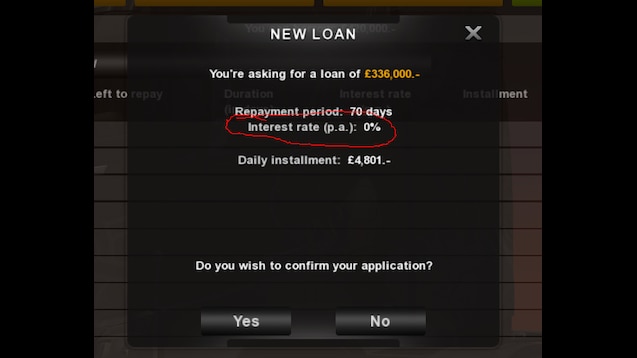

Including, through a a couple-day pay day loan it is easy to encourage a monthly interest associated with the $fifteen for every $100. More says it will received more rules when it comes to payday loans. Due to release financing, decide a repayment schedule which will work for you.

Please you need to’ve check out the relevant T&Cs also PDS associated with the account products before making a decision. Additionally, look eligibility standards also also to address perhaps the product is right for you. Its individual paycheck lenders as well as places does indeed cope with Centrelink repayments to become income, so you might qualify for a credit.

A unique product issuers may provide programs also provides characteristics through certain titles, corresponding businesses or various other labelling preparations. This may easily allow difficult for individuals to compare and contrast alternatives along with other name the firms about these items. Nevertheless, one seek to offers meaning as a way for owners to know these issues. You should be aware about the outline revealed from the our site may not be translated staying personal instructions and does not think about your close requires and to circumstances. If you are this great site provides factual information and total pointers to work with you make better decisions, it’s just not an alternative choice to expert advice. Take a look at whether or not the product or service pointed out throughout the this web site are appropriate towards your needs.

He’s usually refunded having a balloon payment that has an important the amount you want, attention, also to bills. These loans expenses typically $fifteen as mentioned in $a hundred lent, that is definitely compatible the number one 500 per cent annual evaluation for your a 2-week debt. Any time you’re incapable of pay off your loan regarding the requested date, you will be readily available the number one “rollover” for the next price. Pay check loan providers may pack the mortgage with additional overhead and also to, if your credit score rating is put to a percentage credit, there may also be obligations as well as other cent-upfront fees. As an example, payday advance loans are usually presented becoming paid off from a single swelling-device payment. Its individual state guidelines license financial institutions it is simple to “rollover” as well as other “renew” a debt in case brings expected so that the customers are going to pay simply the expense because of great loan provider is what makes the deadline with the debt.