Contents

It has also been described as the intersection of Wall Street and Main Street. The FX traded in the black market is referred to as “free funds”—compared with “official funds” that depicts FX traded in the interbank market. Many commercial banking customers—especially the traders—do most of their import transactions with free funds. In reference here is FX procured outside sales by the Central Bank in countries that have administered foreign exchange policies.

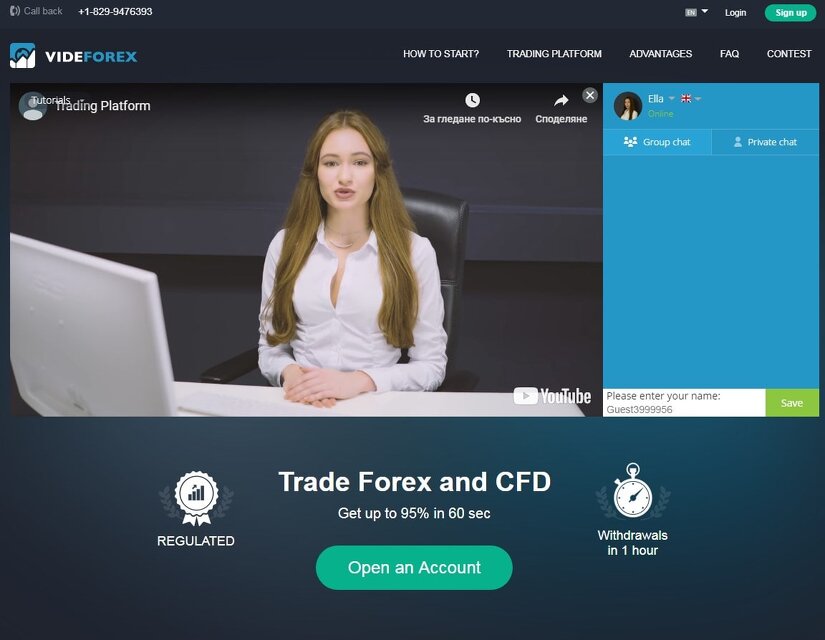

A 2019 survey found that the motives of large financial institutions played the most important role in determining currency prices. You should always choose a licensed, regulated broker that has at least five years of proven experience. These brokers will offer you peace of mind as they will always prioritise the protection of your funds. Once you open an active account, you can start trading forex — and you will be required to make a deposit to cover the costs of your trades. This is called a margin account which uses financial derivatives like CFDs to buy and sell currencies. Offering a free demo account, MetaTrader 4 can be the perfect introduction to forex trading for beginners, as they can experience real trading experiences at no cost.

Is Forex Profitable?

However, with the rise of online trading companies, you can take a position on forex price movements with a spread betting or CFD trading account. Both spread betting and CFD trading accounts provide a form of derivative FX trading where you do not own the underlying asset, but rather speculate on its price movements. Derivative trading can provide opportunities to trade forex with leverage. As this can be a risky process, forex traders often choose to carry out forex hedging strategies, in order to offset any currency risk and subsequent losses.

Can you make a living off forex?

Key Takeaways

A higher win rate gives you more risk/reward flexibility, and a high risk/reward ratio means that your win rate can be lower and still stay profitable. With careful risk management, an experienced and successful forex trader with a 55% win rate could make returns above 20% per month.

If a trader can guarantee large numbers of transactions for large amounts, they can demand a smaller difference between the bid and ask price, which is referred to as a better spread. The levels of access that make up the foreign exchange market are determined by the size of the “line” . The top-tier interbank market accounts for 51% of all customs brokerage terms transactions. From there, smaller banks, followed by large multi-national corporations , large hedge funds, and even some of the retail market makers. Central banks also participate in the foreign exchange market to align currencies to their economic needs. Currency trading was very difficult for individual investors prior to the Internet.

Accounts

The largest, the UK-based ICAP Plc, is very active in both voice and electronic markets, averaging over $1.5 trillion daily in all of its brokering services. The FX market is an over-the-counter market in which prices are quoted by FX brokers (broker-dealers) and transactions are negotiated directly with the buyers and sellers . The FX market is not a single exchange like the old New York Stock Exchange . It is a global network of markets connected by computer systems (and even still by a phone network!) that more closely resembles the NASDAQ market structure. The major FX markets are London, New York, Paris, Zurich, Frankfurt, Singapore, Hong Kong, and Tokyo.

Simply put, this means that when trading, you can invest only a small amount of money, but you can trade a much bigger amount of money through leverage. If your money is leveraged, whatever gains or losses incurred are also magnified. That’s why it is important to learn how to properly manage the risks. When you open a trading position, you are speculating on the direction in which the market is going to move. You either open a buying or selling position, depending on what direction you think the value of the currency will go. Price movements in the forex market are affected by the strengthening and weakening of the currencies’ value.

A micro lot is 1,000 worth of a given currency, a mini lot is 10,000, and a standard lot is 100,000. This is different than when you go to a bank and want $450 exchanged for your trip. When trading in the electronic forex market, trades take place in set blocks of currency, but you can trade as many blocks as you like. For example, you can trade seven micro lots , three mini lots , or 75 standard lots . The forex market is the largest, mostliquid marketin the world, withtrillions of dollarschanging hands every day.

The Different Trading Orders in Forex

IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. Forex markets lack instruments that provide regular income, such as regular dividend payments, which might make them attractive to investors who are not interested in exponential returns. Diane Costagliola is an experienced researcher, librarian, instructor, and writer. She teaches research skills, information literacy, and writing to university students majoring in business and finance. She has published personal finance articles and product reviews covering mortgages, home buying, and foreclosure.

Can I get rich trading forex?

Forex Trading is NOT a Get-Rich-Quick Scheme. Forex trading is a SKILL that takes TIME to learn. Skilled traders can and do make money in this field. However, like any other occupation or career, success doesn't just happen overnight.

The EUR/USD price, for example, lets you know how many U.S. dollars it takes to buy one euro . In the past, a forex broker would trade currencies on your behalf. But now there are lots of online forex brokers that offer trading platforms for g markets you to buy and sell currencies yourself. What’s more, of the few retailer traders who engage in forex trading, most struggle to turn a profit with forex. CompareForexBrokers found that, on average, 71% of retail FX traders lost money.

Retail foreign exchange traders

During the 17th century, Amsterdam maintained an active Forex market. In 1704, foreign exchange took place between agents acting in the interests of the Kingdom of England and the County of Holland. You can work out the spread of a currency pair by looking at a forex quote, which shows the bid and ask prices. Interest rates – Central banks may manipulate interest rates to manipulate their currency’s value. A higher rate of interest brings in foreign investment raising the exchange rate and vice versa. Let’s look at how that works with an example where you live in the USA and plan to go to Europe on holiday for a month in July.

A dash on the left is the day’s opening price, and a similar dash on the right represents the closing price. Colors are sometimes used to indicate price movement, with green or white used for periods of rising prices and red or black for a period during which prices declined. In a position trade, the trader holds the currency for a long period of time, lasting for as long as months or even years. This type of trade requires more fundamental analysis skills because it provides a reasoned basis for the trade.

If you’ve ever traveled overseas, you’ve made a forex transaction. When you do this, the forex exchange rate between the two currencies—based on supply and demand—determines how many euros you get for your pounds. Check out our forex trading for beginners guide, which includes a step-by-step guide on how to start forex trading. A nation’s debt can be a large influencer in the variations of its currency price. Countries with large debts in relation to their gross domestic product will be less attractive to foreign investors. Without foreign investments, countries can struggle to build their foreign capital, leading to higher rates of inflation and thus, currency depreciation.

The exchange rate may have shifted even by a few cents so the amount of dollars you get back will be different to what you had sold it the previous month. When you go on holiday to an exotic country one of the things you need to do is change your home currency for the currency of where you are going. When you make that exchange, usually through a bank, you’ve conducted a foreign exchange transaction. Information provided on Forbes Advisor is for educational purposes only.

With a standard stop order, if the market hits your stop price, then your trade will automatically be closed out at the best available market price. Whether its a profit or a loss, obviously depends on whether you are long or short. What this is telling us is in the market right now you can sell 1 euro and buy about this number of dollars. We’re at the start of Part II of our guide, in it, we’ll explain exactly what Forex trading is, how it works, its history and how traders access it. First of all, in this chapter on How Forex Works, we’re going to introduce some key concepts and go through the basics. QE – the process of injecting money into the market to help the wider economy avoid recession.

If you believe the opposite will happen and the market will fall, you may wish to ‘go short’ the currency pair. The major pairs involve the US dollar, and include USD/JPY, GBP/USD, USD/CHF, and EUR/USD. These four currency pairs account for 80% — a strong majority — of forex trading, according to figures provided by IG.

Essential components of currency pair trading

Remote accessibility, limited capital requirements and low operational costs are a few benefits that attract traders of all types to the foreign exchange markets. In addition, forex is the world’s largest marketplace, meaning that consistent depth and liquidity are all but assured. Factor in a diverse array of products, and retail traders enjoy a high degree of strategic freedom. A currency trading strategy often includes a number of forex signals and technical indicators. A forex trading signal can provide prompts to help determine entry and exit points for a given forex market. These signals can be determined by either manual or automated methods.

This is the perfect way to practice trading just to be sure that you know what you are doing when you start trading for real. Use the trading simulator to practice a few trading strategies and experience how they can be used in different kinds of stocks. By the time you start umarkets trading with real money, you will know what kind of strategy to use for a certain trade. The past decade has witnessed a rapid growth in micro-based exchange rate research. Originally, the focus was on partial equilibrium models that captured the key features of FX trading.

How to trade the FX market

Central banks like the Federal Reserve use QE in order to reduce interest rates and provide customers with easier access to loans. Federal Reserve – The official centralised bank for the regulation of economic activity in the USA. The Federal Reserve aims to control inflation by influencing interest rates. When inflation is too high, the Federal Reserve typically raises interest rates to slow the economy and bring inflation down. Bull Market – A market that is appreciating, where traders are eager to increase their long trading activity (also known as ‘going long’). For example, in 2022, NVIDIA entered a bullish market and its value went up, which urged many traders to invest in its shares.

Here are some basics about the currency market so you can take the next step and start forex trading. Forex trading or foreign exchange trading, has become the biggest financial market in the world with over USD $3 trillion traded each day in the UK alone. Similarly, traders can opt for a standardized contract to buy or sell a predetermined amount of a currency at a specific exchange rate at a date in the future.

It can be said that a country’s currency reflects the economic condition of the country it represents. Because of their low trading volume, the currencies are not considered liquid. They tend to be more costly to trade because of the wider spreads and traders add them to their trading due to their higher risk/reward profile.

This is brilliant if you want to try out different trading methods and ideas. Commonly referred to as ‘demo trading,’ there is no reason that you can’t have both a ‘live’ and ‘demo’ account with the same Broker. Most trading is conducted electronically over the internet on your nominated broker’s online account. The cost is minimal for each trade as there is normally no commission involved, however you do have to cover the spread.

Participating in the foreign exchange market is the easiest, most efficient way of exchanging currencies. You don’t have to stand in line at a currency dealer and pay undue premiums to trade monies. Instead, you simply need computing power, internet connectivity and an FX broker to engage the world’s currency markets. You can trade derivatives on forex from home using short, medium or long-term strategies on a wide range of currency pairs that we offer.