Family guarantee fund and you will HELOCs should be wise a method to spend out of credit cards and you can save well on interest. Discover drawbacks, even if, including the exposure it twist to your residence.

Of many or all the enterprises looked provide compensation to LendEDU. Such earnings was how exactly we take care of our very own free service getting consumerspensation, and additionally circumstances off when you look at the-breadth editorial browse, decides in which & how businesses appear on our very own site.

When you are a resident, one solution is to make use of the brand new guarantee you built in their household. By-turning you to security for the cash, you might pay back expense and reduce their enough time-label notice will cost you.

Nevertheless, it flow isn’t suitable for group. If you’re considering playing with a property equity mortgage to repay personal credit card debt, keep reading knowing a complete pros, disadvantages, and you may processes for doing so.

The reasons why you manage consider using a home security mortgage to invest from credit debt

Guarantee is the difference in your own residence’s well worth along with your home loan balances. So as you have to pay away from the financial, your collateral increases. It also develops as your domestic goes up in the worthy of.

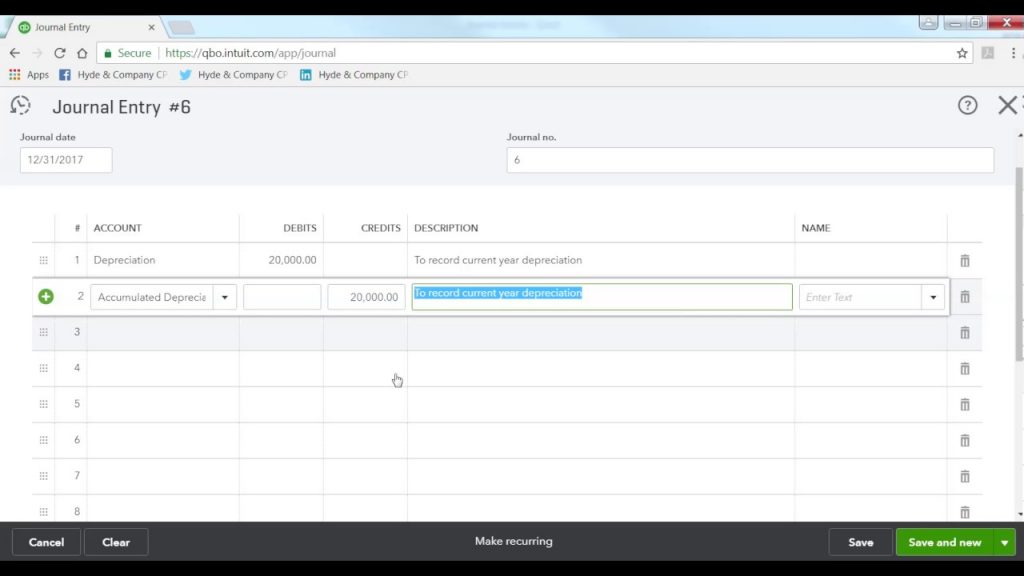

Once you generate adequate equity, you can control they that have a house collateral financing otherwise HELOC (house security credit line), and this fundamentally turns that equity into cash you can make use of getting one mission-including paying down playing cards or other types of obligations.

Discover plenty of causes you may want to create which. First https://paydayloanalabama.com/collinsville/, household security money was safeguarded by guarantee (your house), so they normally have dramatically reduced interest levels than credit cards. However they will let you roll the cards balances to your a beneficial single payment, making it easier to trace and you can pay-off.

Any time you play with property collateral mortgage to settle borrowing from the bank cards?

Even after most of the positives it comes which have, having fun with security to repay your own credit cards isn’t really always this new answer. There are even particular drawbacks you will need to thought before you choose that it street.

Earliest, house guarantee funds make use of family as the guarantee. That implies you could be foreclosed towards the if you’re unable to build money. That is not the same as handmade cards, which happen to be unsecured. For individuals who standard throughout these, your own borrowing from the bank will take a knock, however you may not be susceptible to dropping your property.

Household guarantee fund plus do not target the underlying of your own problem. If you have issues keeping your expenses down, you may find oneself straight back the place you already been-large credit card debt and all.

Pros and cons of using property security financing to pay of credit debt

Which have any financial equipment, discover positives and negatives to take on-and you will family collateral loans are not any more. Discover less than to know the full scope of those services how they can impression your loved ones.

Pro: All the way down rates of interest

Credit cards are apt to have a lot higher pricing than household equity fund because they are maybe not secured from the any guarantee. Thus, by using property security loan to repay the card stability, your change the individuals higher rates having a lesser you to definitely-saving you rather to the demand for the near future.

Currently, home guarantee loan pricing have the 5% to help you six% variety, according to an analysis out of loan providers. Handmade cards, additionally, mediocre 15% price.

Pro: Improve money

If you utilize a home collateral financing to pay off your own credit cards, it streamlines the fresh balance into the a single mortgage. That means you no longer keeps multiple bank card money to help you create each month and you will, alternatively, make one fee to your residence guarantee bank.