The mortgage financing processes concerns many different actions and you can stages. These types of private methods circulate the loan file submit that assist your reach the finish line, which is the final closing.

However, in the act, you could stumble on what is called a conditional approval out of your mortgage lender. It indicates needed some considerably more details away from you, to help you clear you to have closure.

Conditional Home loan Acceptance Said

Conditional acceptance: Within the a mortgage financing context, good conditional approval takes place when the home loan underwriter is mostly found with the application for the loan file. However, there are a minumum of one conditions that have to be fixed until the offer is intimate.

So you could think of it given that a green white that have an enthusiastic asterisk. The lender have assessed the job and you will supporting data, and total they like what they pick. Nonetheless you desire a couple of things looked from before it is thing a final approval.

Underwriting: This is where the mortgage financial assesses your debts, creditworthiness, as well as the possessions you happen to be to shop for to choose for individuals who qualify for financing. It will help the lending company decide whether to agree the loan, deny they, otherwise point a conditional approval demanding additional tips.

Throughout underwriting, the lender product reviews all aspects like your money, possessions, expense, credit rating, a job status, therefore the appraisal of the house becoming purchased. This is accomplished to measure risk in order to guarantee the financing suits people secondary conditions on FHA, Va, Freddie Mac computer, etc.

Whether your underwriter discovers that the loan matches very criteria however, features a number of a fantastic products to address, it is termed a conditional financial acceptance.

How it Matches On Broader Processes

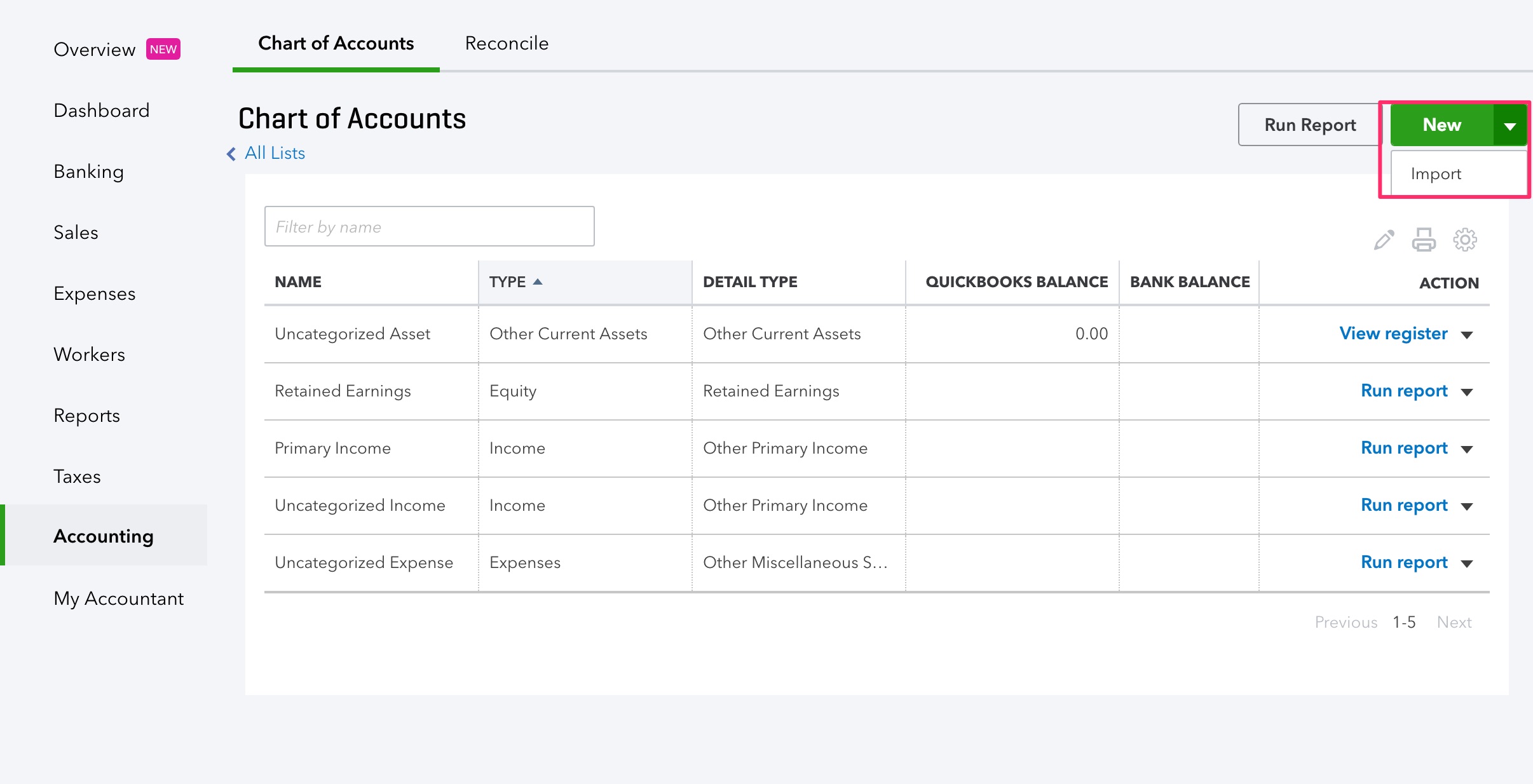

To put this for the a larger context, let’s glance at the easy steps you to definitely happen inside mortgage loan process, including the conditional acceptance. Although this procedure can differ slightly from just one purchase into the second, they always appears something such as that it.

Because this visual shows, a house consumer who obtains an excellent conditional recognition regarding the underwriting team (step) have to care for those items just before capable move on to the fresh new closing (action 6). Closing occurs when you signal the finalized real estate and you will mortgage data files and you will seal the offer.

Sensible Instance of a beneficial Conditional Approval

John and Jane has actually applied for a mortgage, and they’ve offered all files its financial has actually expected up until now. The mortgage document then progresses towards the underwriter, exactly who feedback they More about the author to own completeness and you can accuracy. The guy together with checks the latest file to be certain most of the mortgage standards was in fact came across.

The fresh underwriter determines that individuals was eligible for financing, and that the latest file consists of everything you necessary to see requirements. Having that exemption. A huge deposit was created towards the borrowers’ checking account inside the last couple weeks, while the underwriter cannot influence where those funds showed up out of.

Thus, the guy points just what number so you can a conditional acceptance with the financial mortgage. The guy relates they returning to the loan administrator otherwise processor chip and you may claims the guy must understand source of the previous put. This is exactly a condition to last approval. So it goods must be fixed till the underwriter normally point out that the borrowed funds was obvious to close.

So now golf ball is back on the borrowers’ legal. Obtained essentially become provided a task to accomplish. To fulfill that it consult, they want to render a page regarding factor (LOX) that may enter the mortgage file.

When the John and Jane is fully file the source of one’s down-payment – therefore turns out that the currency came from an approved supply – the mortgage is acknowledged. The very last standards was basically cleared, and couple can now proceed to personal towards the domestic.