Editorial Direction

Focusing on how to see their monthly financial declaration will help you to monitor how quickly you’re paying off the loan, also make it easier to room people transform for the percentage otherwise whom you shall be and also make your repayments in order to.

On this page

- What is actually home financing declaration?

- Just what a mortgage report ends up

- Why should you see the financial report

- Learning to make a mortgage fee

What exactly is home financing statement?

A home loan report is an accounting of the many information regarding the home loan, for instance the most recent Moosup quick cash loans balance owed, focus charge, interest rate alter (when you have a varying-price home loan) and a writeup on your existing and you can prior payments.

Lenders is legally needed to provide you with home financing declaration each charging you course inside the lifetime of the loan. The fresh document includes certain loan advice inside a basic style, so you know the way per buck of mortgage payment is spent.

Exactly what a mortgage statement ends up

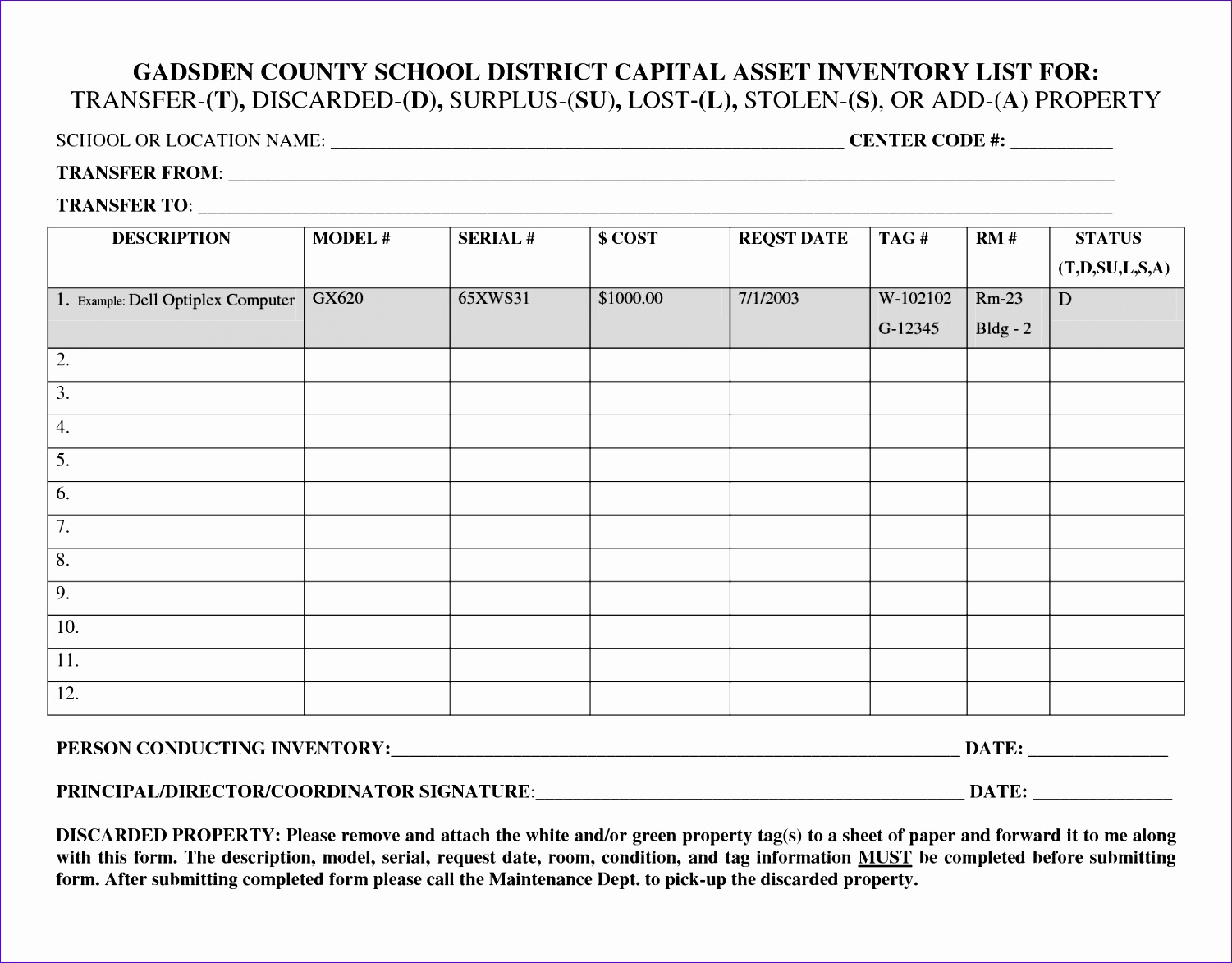

An individual Mortgage Shelter Bureau (CFPB) written an example document with the their webpages, and that LendingTree adapted below to explain each part of the mortgage statement. Follow the number on the artwork less than to have a section-by-point overview of precisely what the statement tells you.

step 1. Mortgage servicer guidance

Home financing servicer ‘s the organization one to accumulates your payments and you will makes your own monthly statements. (Observe that they elizabeth business you closed your loan having.) The brand new servicer’s contact details shall be exhibited right here, to arrive at these with questions regarding statement.

2. Account amount

Your bank account or financing matter is tied to their identity and you will your house that is financed by financing. You will need to have the financing matter useful if you are contacting the loan servicer with questions relating to the mortgage.

Mortgage payments are typically due toward first of virtually any month, regardless if very servicers leave you an elegance chronilogical age of 14 days past the due date just before you are energized a later part of the percentage. However, providing you make payment in this 1 month off the deadline, your credit history won’t reveal brand new payment once the later.

Your homeloan payment is actually commercially later if not spend it because of the to begin brand new times. Your report includes an effective in the event the paid down once number detailed with a belated percentage, that is generally billed if one makes your fee adopting the 15th of your own week.

5. An excellent dominating number

This is actually the amount you still owe in your home loan shortly after while making the payment per month. For every single commission you create cuts back your dominating, and make a lot more money to repay your financial prior to. not, you may need to alert the servicer in writing that you need even more loans put on your dominating equilibrium.

six. Maturity day

Some comments range from your maturity date, very you’ll know just how close or far you are out-of using away from any balance. Keep in mind that if one makes most costs, the fresh new go out was in the course of time just like the you will be paying down the borrowed funds shorter.

seven. Rate of interest

Attention ‘s the cost you shell out in order to borrow money, and it’s really according to research by the home loan rate your closed from inside the before your finalized the loan. For people who look at the amortization schedule you will have gotten with your closure files, you’ll observe that most of your payment visits need for the first years of your loan.

Keep in mind which part for those who have an adjustable-rates home loan (ARM), so you can understand in the event your price changes. The loan servicer need give you find from after that transform within least two months until the percentage due date tied to brand new earliest and you can next rates alterations. Paying attention to this post may help you decide if its time and energy to re-finance out of a supply so you’re able to a predetermined-price financing.