- General borrower conditions is a credit score out of 620 or maybe more, an excellent DTI of 50% otherwise shorter, and you will a strong credit history.

Evaluating HomeOne and you may Home You can easily: While you are they are both conventional loans which have good step 3% down-payment needs, it disagree in their standards:

- HomeOne: Best for earliest-go out home buyers rather than earnings constraints.

- House You can: Suitable for those with earnings from the otherwise below 80% regarding AMI, and no very first-go out homebuyer needs.

Unsure and that system fits your needs? A good Fairway loan officer can assist you within the determining a knowledgeable mortgage due to the fact a nurse, should it be HomeOne, House It is possible to, or another real estate loan option. Contemplate, having antique finance, individual home loan insurance (PMI) will become necessary if you don’t reach 20% equity, but it is immediately got rid of on 22%.

*Personal mortgage insurance (PMI) relates to traditional financing if borrower’s downpayment was smaller than 20%. PMI closes immediately at the twenty two% family collateral.

dos. Nurse Across the street program

The fresh Nursing assistant Nearby system shines given that yet another alternative getting nurses or any other medical care professionals looking to buy a house. While not a traditional mortgage system, it will not lend money or originate fund. As an alternative, they acts as a comprehensive domestic buyer guidance system, designed specifically to match nurses with suitable property, mortgage lender, and you may educational funding program because of their personal need.

Significantly, Nursing assistant Across the street now offers reasonable financial positives. Grants to own nurses can also be reach up to $8,000 where offered, while the system even offers advance payment guidelines to $10,681. At the same time, nurses will get remove the settlement costs of the skipping certain charge, such as home appraisal will cost you.

It is very important keep in mind that such provides are mainly geared towards first-go out home buyers from the breastfeeding field, looking to get the number one residence. Which stipulation mode the income can not be employed for resource attributes otherwise vacation residential property.

Prior to purchasing this program, nurses are advised to mention county otherwise regional down payment advice apps, which could bring so much more ample scholarships.

3. Home to possess Heroes: Health care masters

Residential property for Heroes caters to a general spectral range of public-service gurus, and additionally healthcare experts for example nurses and nursing assistant practitioners. So it across the country system concentrates on putting some family get economical, not merely to possess nurses, however for firefighters, law enforcement, coaches, and you will army team.

The fresh program’s advantages are high, for the website stating, Most heroes save yourself about $3,000 when purchasing or promoting property around. This type of coupons come from a system of real estate agents, mortgage officials, term people, and domestic inspectors, providing a cumulative work for very often is better than other national programs.

To get this type of gurus, nurses need certainly to work at realtors connected to Home to possess Heroes. As usual, comparing this method with other local choice is advised to be certain it will be the best bet.

cuatro. Conventional home loans for nurses

This type of funds is actually widely prominent certainly one of all types of financial alternatives. Such loans are not authorities-recognized however, https://clickcashadvance.com/installment-loans-md/ always follow Federal national mortgage association and you will Freddie Mac computer assistance, and therefore also referred to as compliant loans.

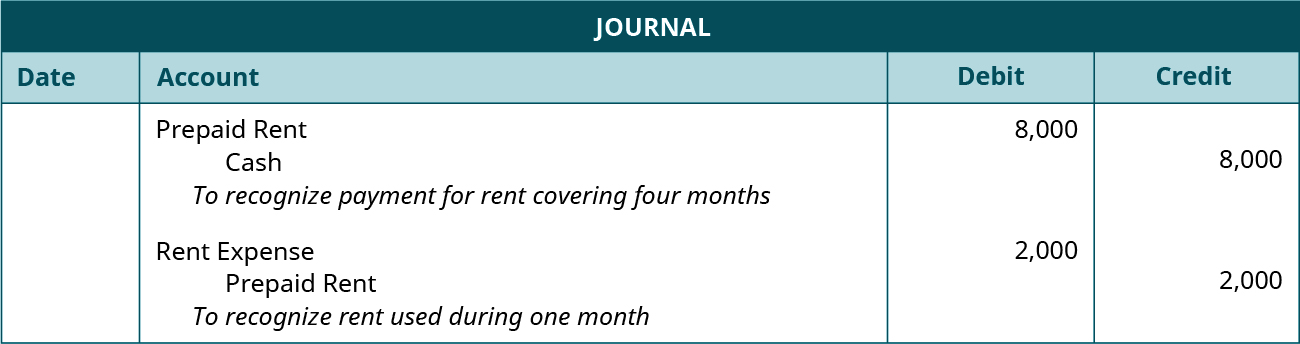

To qualify for a traditional financial, a nursing assistant carry out typically you prefer a credit rating with a minimum of 620. Such loans try tempting with their low down percentage criteria, as low as step three% of the home price. However, it’s important to understand that whether your advance payment try significantly less than 20%, private mortgage insurance coverage (PMI) would be needed, resulting in higher monthly installments.

5. FHA finance getting nurses

FHA financing backed by the fresh new Federal Construction Administration mortgage option for nurses, specifically those which have fico scores ranging from 580 and you can 620. Backed by the Government Houses Management, these types of fund are favored by first-big date homebuyers the help of its versatile financing acceptance assistance.