Comparing Credit Unions to help you Traditional Banking companies

Selecting the most appropriate financial institution is essential, just like the after a single day, anyone desires a financial spouse to hold their difficult-made currency. , people commonly choose anywhere between a financial and you may a credit union. Even though they may sound equivalent on top, there are a few a whole lot more nuanced variations that we will go through lower than:

Ownership

One of the greatest differences between banking companies South Fork CO no credit check loans and you may borrowing unions is actually the control build. Finance companies are belonging to traders, having an intention of generating profits into investors. Supervision from business financial surgery is offered because of the a panel out-of Directors whom drive the lending company to your profitability. On the other hand, credit unions are not-for-funds monetary cooperatives and you may belonging to the members. That usually implies that credit unions give cheaper financial choice, ideal cost towards offers, premium service and service on the members – that are in addition to the investors and tend to be supportive of its local organizations. Credit Unions try similarly influenced by a section regarding Directors, however they are select by credit connection members. So it contrast regarding possession and you can governance out-of finance companies versus borrowing from the bank unions generally contributes to a much better, a lot more individualized banking feel away from credit unions.

Financial Situations

Now days, most credit unions provide most of the exact same products since their financial competitors. Yet not, they are usually confronted by large costs on coupons membership and lower pricing to your money.

Rates

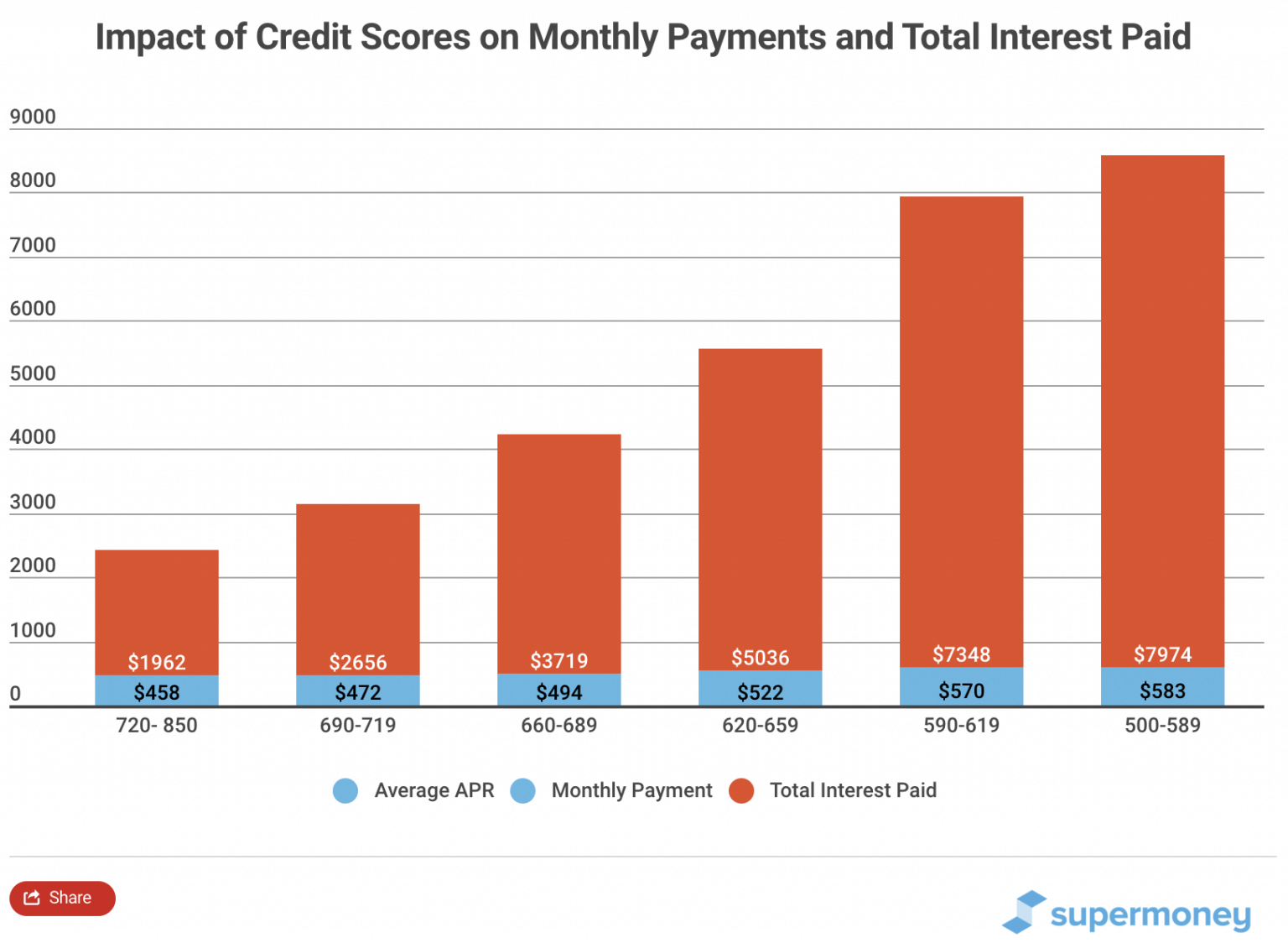

As stated, borrowing unions normally provide straight down interest levels into funds, than simply traditional financial institutions. How does that really work? Because the borrowing unions are low-funds, they often grab the profits’ produced by their products or services and rehearse these to bring less interest levels. This can be one of the most significant competitive experts you to definitely credit unions provides more than traditional banks.

Financial Fees

Because the borrowing unions exists to help their members flourish economically, they normally promote quicker charges because of their members, plus totally free characteristics oftentimes. Conventional financial institutions typically have a world commission for the the accounts if you do not satisfy a collection of standards, instance minimal balance criteria, and often costs large fees getting popular banking problems such as for instance decreased money, thanks to checks, avoid repayments, an such like.

Customer service

That have a mission concerned about support the members, borrowing unions more often than not enjoys an advantage regarding solution and support. After you phone call a card relationship, you’ll keep in touch with an individual who lives and you may performs on your area, rather than a nearby otherwise offshore call center one conventional financial institutions could possibly get fool around with, so that they can most readily useful see your specific demands.

Common Access

Extremely credit unions is hyper-nearby, if you move out regarding county, otherwise traveling from your own area, you may also eradicate the capability to truly see a department of the credit partnership. Big finance companies normally have twigs and you may ATMs located in most major towns. However,, extremely credit unions be involved in a system out of surcharge-free ATMs, as many as 50,000+ and you may broadening, and mutual branching opportunities. Mutual branching lets borrowing connection players the capacity to visit a different sort of borrowing relationship about circle so you’re able to procedure banking purchases. And additionally, towards the extension regarding digital financial and you may use of technical from the most credit unions, banking which have a cards partnership is achievable regardless of where you are living, move or traveling.

Deciding on the best Banking Mate

Typically borrowing unions lacked a number of the cellular and you can technology keeps the traditional financial institutions given. not, that’s not the fact. Really Borrowing Unions keeps the full collection from online and mobile financial products and services, in addition to virtual account opening, and more, like their financial equivalents. Very do not let the fear from hassle avoid you, extremely borrowing unions are really easy to access.