Prior to refinancing your vehicle mortgage, you would like make sure you check out your own reasons for having refinancing, the value of your car or truck additionally the overall cost. Image Credit: Shutterstock

Dubai: Soaring rates have remaining of several automobile consumers stuck that have big fund and higher monthly payments. However with rates of interest becoming lower dramatically now – and much more slices are on the horizon, do you stand to obtain out of refinancing your current auto loan now?

Refinancing involves substitution no less than one present finance with a new you to definitely, generally speaking because of another type of lender. But are you aware that you do an equivalent with a good auto loan?

As the vehicles money can be a considerable amount of your funds, once you have financed your vehicle, you can end up being stuck and purchased the phrase of your own car loan and you can fee. Although not, this doesn’t must be the actual situation.

Car finance refinancing helps you alter every part of your vehicle mortgage – name, rate, charge, etc. Nevertheless you will definitely started at a price and you will possible high count regarding the full paid off interest for those who expand your loan name.

Although not, having rates shedding there’s a lot so much more to take on than just what’s happening with rates into the main financial top.

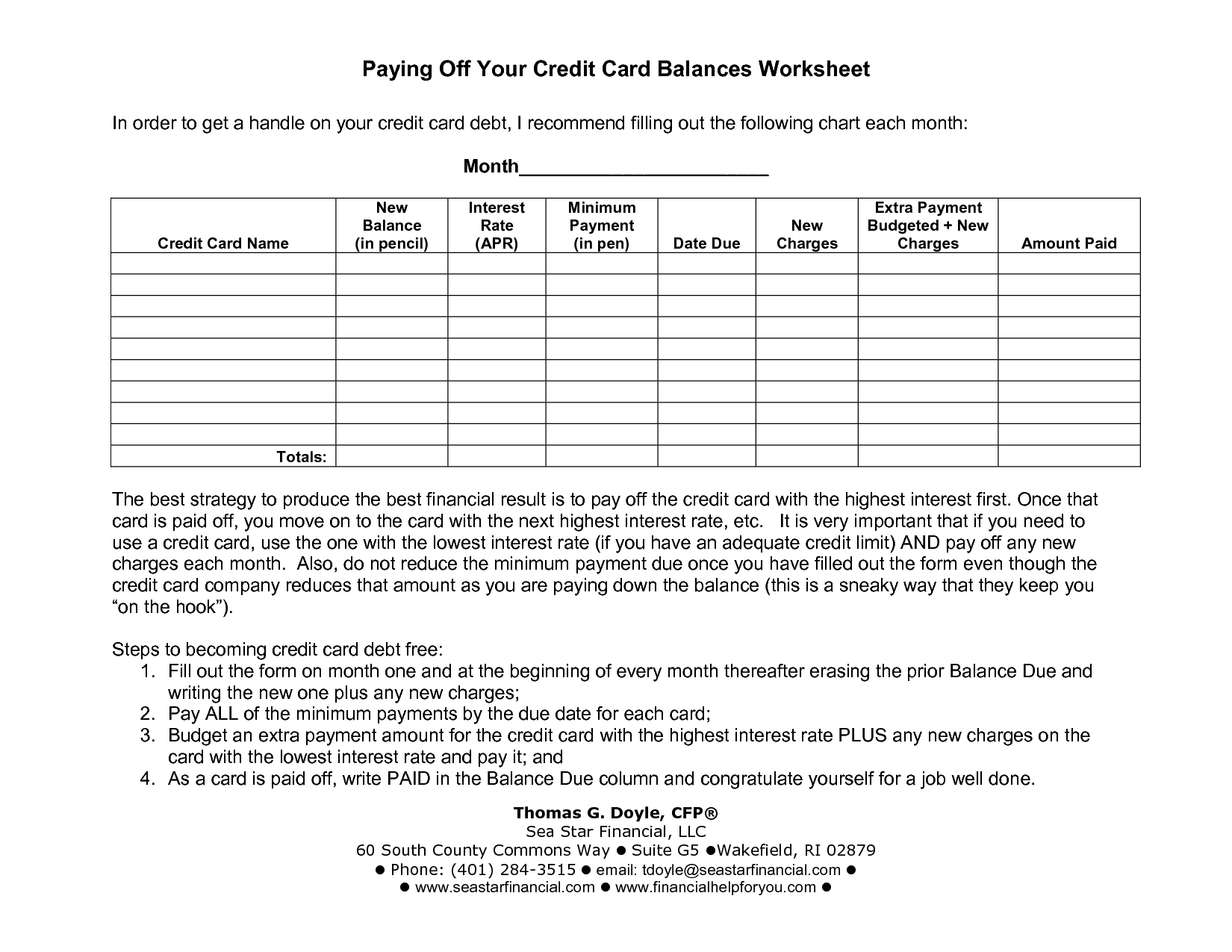

Before refinancing your car or truck mortgage, you would like definitely look into their reasons for having refinancing, the worth of your vehicle as well as the total cost, told me Ibrahim Riba, an elderly automobile insurance and you will financing salesman located in Abu Dhabi. Here are a few criteria you need to think before you begin it.

Why you ought to re-finance my vehicle financing?

1. You may have got a high rate very first and from now on your own bank is offering a very competitive rates because the costs enjoys come decreasing following the recent rate cut.

dos. We would like to shell out your car or truck out-of at some point, but you should not shell out focus or charges getting very early payment.

step three. We want to lower your monthly payment. For those who expand the loan towards a lengthier title, you’re likely to get a lower life expectancy payment per month, particularly if you lock-for the a lowered interest rate.

Even in the event rates have not altered, boosting your credit history could be sufficient to get a lesser rate. The greater your borrowing from the bank, the greater amount of favorable mortgage terms you are getting, added Riba. If you have increased your credit score given that finalizing to suit your very first loan, it’s also possible to qualify for best mortgage terms and conditions.

Do you know the will set you back you will want to consider?

While comparing some vehicles refinance has the benefit of, you should research outside the quoted speed and potential payment per month, explained Jacob Koshy, an effective Dubai-situated automotive world expert, already providing services in within the merchandising pricing as well as how interest levels can impact all of them.

Just before refinancing, contemplate if or not charge will impression your current savings. For example, your car loan possess a great prepayment penalty set up. And additionally determine all round attention along side longevity of the loan.

Refinancing to your a lengthier title mortgage you certainly will mean the outstanding mortgage and you can commission would be higher than the value of your car. Regardless if a bank may let this that occurs, avoid it. You dont want to get into a posture for which you have a tendency to must place more income directly into settle your vehicle financing if you have to sell it.

So in short, when you’re refinancing is a great answer to offer your loan name, never meet or exceed what’s practical for your automobile value.

Any kind of most other threats to take on?

In browse around this website case the aim of refinancing an auto loan would be to shell out it off quicker, enable you to lender discover. They might be in a position to work out a great deal for your requirements that’s like refinancing without having any costs that accompanies using up a different mortgage from an alternate financial, added Riba.