Freddie Mac computer (Government Financial Financial Company) the new relative out of Fannie mae, has come away having a proposal purchasing second mortgages funded about first-mortgage home loans stored because of the government backed organization.

In fact it is a lot of money. Freddie expenditures vast amounts of bucks of mortgages each month. When your offer is approved, property owners will be able to turn its equity for the bucks versus selling their residence or refinancing the existing basic, and that probably keeps a minimal rate shielded from the post-economic crisis, article pandemic ages of preternaturally low mortgage rates.

This really is great news for many those who already have large collateral amounts. They are capable pull out of its family whatever thumb cash they can qualify for, and continue maintaining one to around three . 5 %, thirty year first-mortgage set up.

In reality, it won’t be all that bad for several NBA people people, Matt Ishbia and you may Dan Gilbert, who control United General Mortgage, and you may Skyrocket Home loan correspondingly, both biggest suppliers out-of lenders in the united states

And this will benefit anyone else also: the brand new suggestion will be entitled The loan Brokers Complete Work and you may visit site Income Enhancement Step. Loan cheats will probably think its great. They will certainly have significantly more money to blow into the to acquire baseball users to own the brand new Phoenix Suns and Cleveland Cavaliers.

Within column there is constantly mentioned on tendency of one’s movers of cash, banks, mortgage businesses or other lenders, to help you recite an equivalent mistakes, ad nauseum, and expect different abilities. This notion is actually a prize-winning exemplory case of one madness.

However, hold off: then it had weird- pursuing the 80-20 algorithm, second mortgages had been becoming funded and therefore lead to shared loan in order to value ratios of just one hundred and you can four, actually one hundred and you may ten

About final crazy weeks prior to the fresh Overall economy out of 2008 vast amounts of bucks regarding highest-proportion second mortgage loans was financed since the loan providers strove so you’re able to outrun the new grizzly-bear out-of personal bankruptcy, to help you zero avail, without a doubt. Highest proportion setting a keen 80% very first and you may an excellent 20% 2nd. Exactly what? Proper, class; that adds up to 100%. You discovered things at all. Honest; you simply cannot get this to articles upwards.

It annoyed financial to make occurred on top of the new , and then we all understand what took place after . The newest housing market crashed.

Now, new Freddie Mac computer moments might possibly be regarding an even more conservative shared mortgage to help you worth proportion (CLTV) and they’ll be much better underwritten, and it’s also behind firmly evaluated earliest financing, rather than liars’ finance or any other dangerous mortgages. But, once the 1945, there is unearthed that the You.S. casing places try unpredictable, just in case they sink, they most of the time go vey deep.

Thus, why don’t we all take a breath and you may keep in mind that Freddie’s concept will be floated close to the amount of time you to definitely, in most venues, the price of property is at a record highest.

Invariably, that it image pops into the mind, Martha, hook up the fresh new boat for the Diversity Rover. Thank heaven i had one next lien buying this stuff therefore we might get out-of-town through to the foreclosure profit.

Without a doubt, at some point, there’ll be an excellent boatload off home which will be lower than liquids, where significantly more are owed than its market value. You will see defaults and you may foreclosures with an unavoidable ripple effect toward benefit. How severe that might be was not familiar; but as to why lead to it?

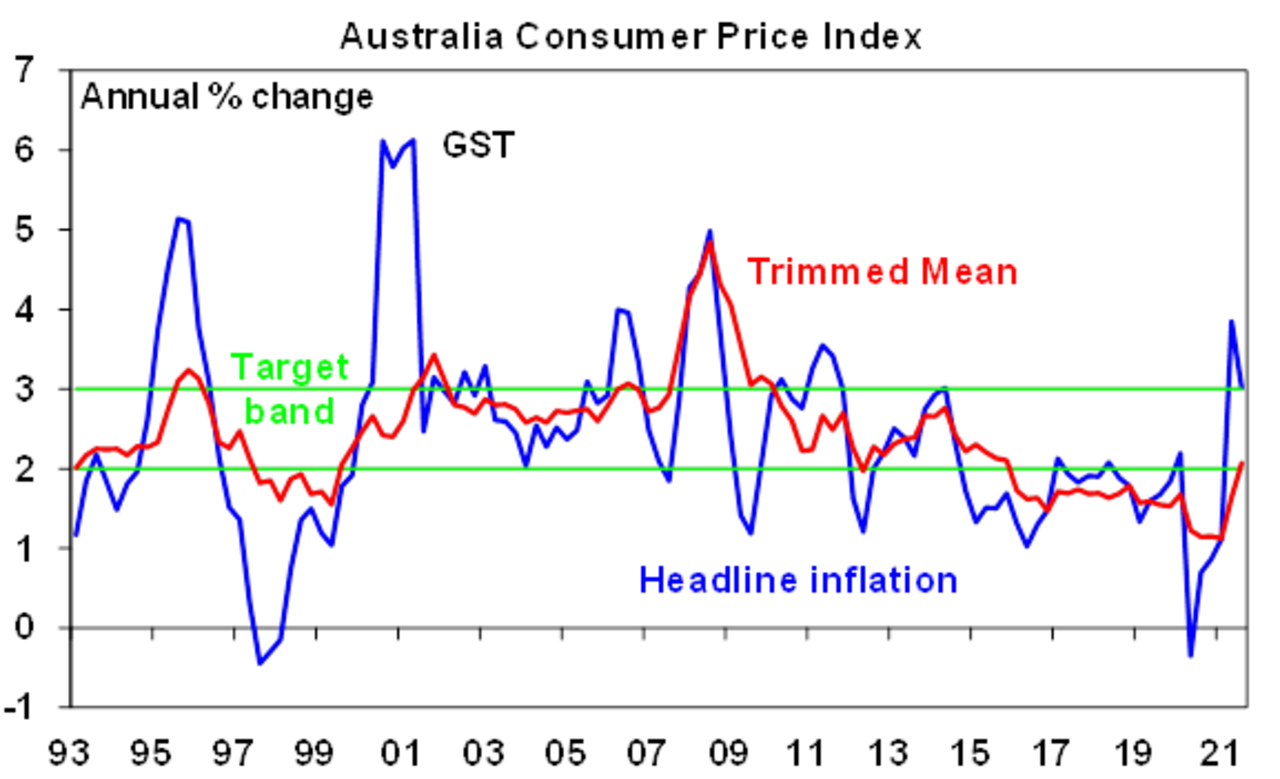

In the long run, the brand new scale create launch vast amounts of bucks to customers so you can eliminate away from as they will. I’m no economist, and i also never gamble one to, however it seems that, inside the a combat facing rising cost of living, it may not be the ideal suggestion so you’re able to jump start user using.

One is reminded of refrain from the newest vintage song In which Have all the latest Troops Gone? compiled by Pete Seeger.