This page are a consume about it issue. It is a collection of individuals posts one to speak about it. Per title is related towards brand-new web log.

In terms of to buy property, there are a lot of expenses and you will charges in the it. From off payments so you’re able to settlement costs, it could be a problem to create the currency you desire yourself. One choice many homebuyers move to gets financial assistance from friends otherwise family unit members when it comes to a present. Yet not, with respect to playing with those funds so you can be eligible for good mortgage, you’ll want to give home financing present page.

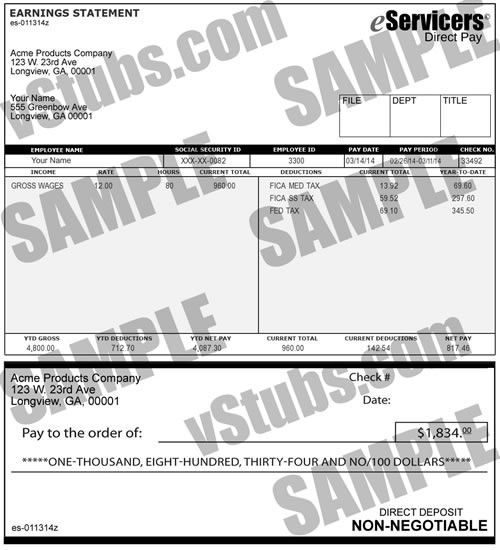

Home financing current letter try a written declaration regarding people providing the money (the new donor) that confirms the bucks are something special and you try not essential to settle it. The new page generally speaking is sold with the level of the brand new provide, the fresh big date the latest provide got, the newest donor’s identity, target, and you may phone number, as well as their relationship to your. This new letter also needs to tend to be an announcement regarding the donor appearing they own no presumption off installment.

step one. He is necessary for extremely loan providers: If you are planning to utilize talented money to help you meet the requirements getting a mortgage, you will probably must give a gift letter with the financial.

dos. They want to see certain standards: The gift page need certainly to see specific standards to be appropriate to the bank. Such as for instance, it needs to be signed and you will old by the donor, plus it have to become the needed advice.

3. They can’t feel finance into the disguise: Their lender have a tendency to scrutinize the new provide letter in order that the brand new money loan places Smoke Rise is its a gift rather than a loan for the disguise. Should your bank suspects that the money is a loan, they might require that you are the repayments on your debt-to-earnings ratio, that’ll connect with your ability so you can be eligible for home financing.

cuatro. They are able to help you be eligible for home financing: If you’re unable to come up with money having an effective downpayment or settlement costs, something special page should be a powerful way to get the money need and you will be eligible for a home loan.

What is actually Home financing Current Page

For example, imagine if you might be to shop for a good $two hundred,000 family along with $8,000 inside savings, but you you want $ten,000 to possess a down payment. Your mother and father promote to offer $2,000 given that a present to safeguards the difference. In this condition, you would have to bring a present letter towards the bank to make use of the $dos,000 towards your deposit.

Basically, home financing present letter is a vital file that will help your be eligible for a home loan that with talented finance. Make sure you follow every guidelines set forth by the financial and you can work directly with your family representative or pal which is offering brand new current in order that everything is securely reported.

2.Who can Offer a home loan Present Letter? [Amazing Web log]

With respect to acquiring a home loan, it’s not uncommon to own borrowers to receive financial assistance away from loved ones professionals or family members. However, extremely loan providers want a home loan current page so you’re able to file the amount of money that are becoming gifted. The new page confirms your money is a gift, not that loan, and this doesn’t have to be paid down. However, who will bring which page?

Essentially, whoever try gifting money provide the loan current letter. This can include mothers, grandparents, sisters, aunts, uncles, cousins, family members, and even employers. It is important to observe that anyone offering the current need to feel the monetary method for get it done.