Blogs

An alternative total condo buyers’ publication, created by Canada Home loan and you may Homes Business (CMHC), can assist homeowners giving the fundamental suggestions wanted to begin on the road to condominium control. Owner made a decision to sell their ranch and you can noted it for sale during the $173,five hundred and you can advised the new Agent he don’t want a great VTB financial when he is 91 yrs old plus poor health. OREAs Standard Variations committee provides additional other insurance policies clause https://happy-gambler.com/king-of-africa/ to include Real estate agents with another option to your Agreement from Purchase and you will Sale. OREA try delighted in order to mention a preferred financial features arrangement with Scotiabank. The knowledge demands away from a real property professional are now able to become met under one roof to your release of the newest OREA Home College or university. Most top undertaking Real estate professionals will say to you you to to succeed in the organization of home you have to know on your own better and get usually improving your experience.

Foundation board out of directors to own 2014

The newest Border newsletter spoke in order to Real estate professionals from along the province just who mutual the viewpoint on the guides and you will tips to ring in 2015. A small amount of overvaluation are seen because of the Canada Mortgage and you may Property Corporation (CMHC), and therefore house cost in the nation is actually a little more than what root items strongly recommend they must be. Of numerous partners realize that working together at the same home brokerage strengthens each other the relationship and their team, in addition to drawing to the complementary knowledge.

OREA chairman searched for the broadcast let you know

Canada’s large four banking companies have started increasing rates to the particular fixed mortgages, for instance the standard four-year mortgage. Effective February 30, 2010, the new ecoENERGY Retrofit program you to given gives of up to $5,000 so you can Canadians just who make house more energy-efficient, avoided recognizing the new reservations to own pre-retrofit analysis. Amuse support for the Real estate agents Worry Foundation’s fifth yearly Real estate professional journey to own foundation, a motorbike journey meant for protection-relevant charities. If the Bank away from Canada (B of C) elevated their right away financing rate by the twenty-five base items inside the July, it sent anxiety to your minds of several might possibly be household buyers.

The new OREA Middle to possess Management Advancement is now recognizing software to own Leadership Educators to educate the newest newly install frontrunners courses. Low-income older people and disabled people in the metropolis of Ottawa whom individual their homes could possibly defer some of the taxes to their assets. The issue in cases like this is whether or not the large financial company is engaged pursuant so you can a contract of services otherwise a contract to possess features.

The brand new customer’s broker connectivity a merchant and you can asks for a listing away from enabled spends of one’s unlisted house zoned “road commercial.” He could be given more information on allowed spends. Amuse help to the Real estate agents Care and attention Base’s next annual Real estate professional drive to own charity, a motorcycle drive meant for security-associated charities. The new National Organization from Environmentally friendly Representatives and Agents (NAGAB) offers a good Greenrealestate™ system causing the brand new Accredited Green Agent™ and you may Accredited Eco-friendly Broker™ (AGA™ & AGB™) designations. An electrical power away from selling try a pressured sale out of property by the an excellent mortgagee because of a standard of one or higher of your own mortgagor’s debt under the mortgage.

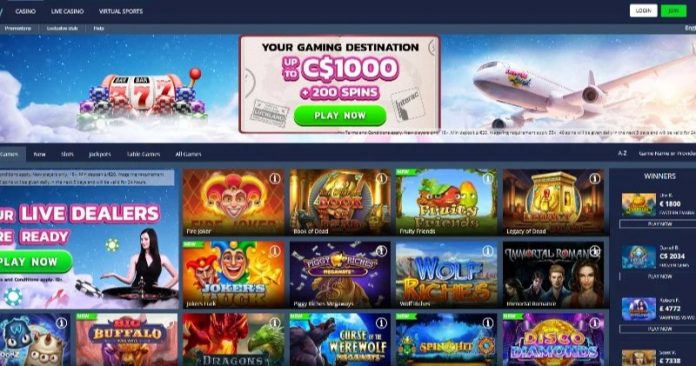

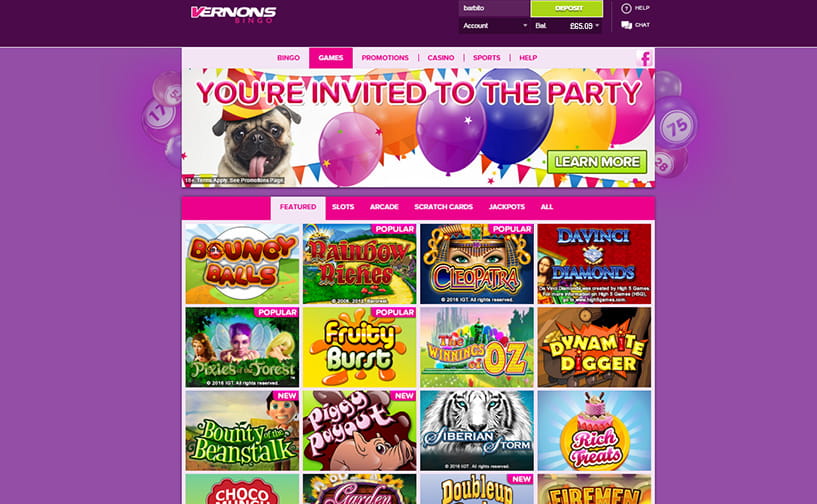

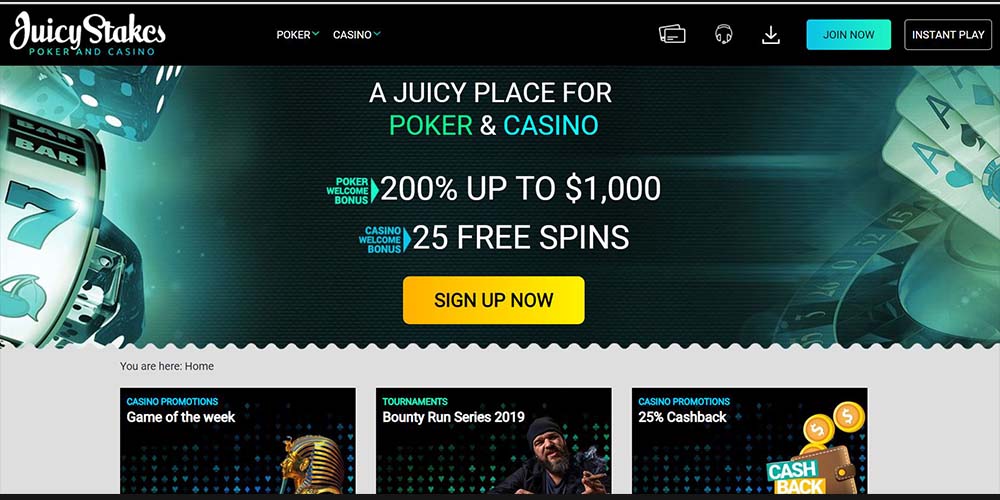

Help make your on-line casino gambling safe, fun, and you may profitable which have sincere and unbiased analysis from the CasinosHunter! Discover your own greatest online casinos, pick the greatest-using real money incentives, see the newest games, and read private Q&As with the newest iGaming leaders at the CasinosHunter. In the most instances, the low put gambling enterprises wagering criteria for $1 put bonuses does not disagree much from those in the average online casinos, so that you will discover the brand new x200 playthrough. 100 percent free revolves are one of the better items that an online casino that have a good $step one put can offer so you can an individual who would like to play real casino games that have the absolute minimum deposit, while the JackpotCity gambling enterprise otherwise 7Bit gambling establishment manage.

A binding agreement became null and you can gap once versions just weren’t done properly and a notification waiving criteria was not produced personally in order to the vendor. Make sure that your a property adverts proceed with the provincial guidance to end problems and you can penalties and fees to own not true or misleading advertising. The industry regulator, the real Property Council of Ontario, contours a few of the most well-known mistakes watched inside home ads. An alternative mode can be found so you can comply with laws aimed at blocking phantom also provides. The brand new Ontario A property Relationship has generated Form 801, an offer bottom line file one meets the brand new conditions away from Bill 55, The brand new More powerful Protection to own Customers Operate. A primary videos and you can internet lesson make it easier to discover Form 801, the newest document created to let comply with regulations to avoid phantom offers.

Wireless technologies are becoming more common inside laptops, PDAs, and particularly mobile phones. Powering suppliers from the sales of the residence is constantly easier if they are in the process with some degree. The fresh mortgagee become an uk Columbia foreclosures action plus the court ordered that possessions were to end up being ended up selling.

The new consumers have been drawn to a waterfront parcel which have use of the area coastline. Wording in the a property checklist lead to disciplinary action up against a couple of registrants. The fresh and you may thorough look from the customers along side province may help one to create your realtor industry. These types of understanding have a tendency to considerably help you in expertise the local business. Find out more about suitable models and you may clauses always address the particular challenges out of condo orders.

Compulsory assessment to own radon gasoline in private home may become a good position away from sales when the Wellness Canada gets into suggestions for more strict radon assistance. The new Chief executive officer of AIG United Guaranty, the 3rd company to incorporate mortgage insurance policies inside Canada close to CMHC and Genworth Economic, predicts fifty-season mortgages might possibly be found in the long term. The newest Small Offer software plan to possess OREA simple versions, formerly created by Nereosoft, is developed by FormPaper Inc. Bell Canada offers a new, personalized monitoring provider that is controlled by the newest resident via a secure individualized Web site.

REALTOR advertisement venture produces to the victory

Agent workingBrokerages have a tendency to today have the ability to render consumers far more alternatives on exactly how to purchase a house features. If you wish to stay on the brand new vanguard away from technical in the home, arrived at a minumum of one in the the next and you will popular show away from situations supplied by the fresh Ontario A house Connection. If you would like stick to the newest innovative out of technical in the a home, arrived at no less than one within the a number of incidents offered in the weeks to come from the Ontario A house Organization. The brand new consumer for the Ontario amusement possessions is an extended-day creator. The brand new quick, dark days now of the year render a way to change your own attention to house security.

Centered on a recently available Regal LePage survey, 51 % from earliest-go out people inside the 2004 were ladies, compared to forty-two percent for males. The new consumers bought an excellent 70-year-old family to own $650,one hundred thousand together with a house examination one detailed repairs amounting to $70,100 and major work with the newest rooftop. Basic conditions can indicate the essential difference between a soft home transaction and you can a great deal went wrong. The fresh buyers used a great 13 year old questionnaire and this performed maybe not reveal that the new garage encroached to your neighbour’s possessions.

There is nothing you can see, listen to otherwise scale you to definitely reveals a good stigmatized possessions, but real estate agents should understand the difficulties whenever symbolizing customers, claims the genuine Estate Council away from Ontario (RECO). Digital signatures are now being put more about within the a property purchases. To maintain the stability while using e-signatures, participate in an upcoming online convention. If you’d like to grow your experience with industrial a property, arrive at one of two events organized as an element of OREA’s slip Arise roster. Participate in a workshop to know about variations you to can help you grasp the procedure.

The consumer shown an offer to your merchant whom chatted about they with her husband. New service development in the computer technology community may be the posts spy step-thrillers are made from. OREA is known as a frontrunner in the high quality carried on knowledge not simply regarding the province from Ontario, but across the country. The seller, client’s attorneys, consumer’s agent and you can seller’s representative were the guilty of neglect inside failing woefully to securely handle assets measurements and you will parking conditions. The regulations for the home industry to possess anti-currency laundering and you will anti-radical financing got influence on June 23rd, 2008. By Oct fifteenth, 40-year mortgage loans no currency off will not getting shielded from the authorities insurance program administered because of the Canada Financial and you may Housing (CMHC).