It is critical to keep in mind that the mixture of getting an adverse credit history being a foreign federal can aid in reducing your financial alternatives

- Lenders have to comment your income, credit history and costs and you may establish their term and you may credit history.

- Nonetheless they want to see just how safe you are economically (eg, just how much you have made and you will what kind of business safeguards you have) and if you have got managed your bank account dependably (for example one missed payments otherwise reputation of unsecured loans).

- That it aims to determine whether you can preserve up with your mortgage repayments over time bad credit installment loans Kansas.

Before you even submit an application for a mortgage, starting an uk savings account is important. Contain the checking account active to construct a card impact into the the uk.

With permanent a position in the uk will also be a large resource towards home loan application since it suggests that you are residing in great britain a lot of time-identity and now have a particular quantity of employment safeguards.

This may as well as spend to work well with a specialist large financial company. A talented mortgage broker could get a hold of you the better loan providers for the items and counsel you precisely how most useful to arrange for the mortgage software.

At the Clifton Personal Funds, we have an award-winning customer services cluster and pride ourselves on delivering a superb client experience.

Example: Understand our very own research study regarding how we helped the international national visitors get finance buying a good ?1.17M London property

To try to get a skilled Staff member Charge home loan, you will need Evidence of ID and you may proof of residency particularly an excellent passport and you will visa

You will need to observe that the mixture of experiencing a keen adverse credit rating being a different federal can lessen your mortgage possibilities

- Proof address Constantly bills regarding the past 3 months with your label and you may target into the, or a beneficial council taxation page about most recent 12 months

It’s important to keep in mind that the blend of getting an enthusiastic bad credit rating being a foreign national can lessen your home loan possibilities

- Proof of money Payslips in the past three months

It is critical to observe that the blend having an adverse credit score being a foreign national can reduce your home loan choices

- Loan providers might want to comment their monthly costs and you can one financing you have got yet , to repay, such credit card bills.

This information is needed so that the financial can see when the your complement new criteria to offer you a package. The fresh new strictness of them criteria hinges on the lending company, as they all the level some in different ways.

Whenever lenders assess this short article, they dictate the danger peak in order to give to you personally centered on your circumstances. The risk of the possibility loan are determined compliment of situations such as for instance as:

It is important to observe that the mixture of experiencing an negative credit rating and being a different national can aid in reducing your own financial solutions

- Exactly how likely your needs varies (Just like your United kingdom house or your job) and you can if or not possible be able to keep up with the newest repayments whether or not your circumstances do changes

It is essential to note that the blend of obtaining an adverse credit score and being a foreign national can reduce your own mortgage selection

- Their tune history getting maintaining costs previously (Such as for example. Your credit history, paying debts on time etcetera.)

Must i Get a skilled Employee Home loan basically Has a beneficial Less than perfect credit Get?

Getting a different national without permanent house presents unique risks one to some lenders avoid. Poor credit is visible because the a sign that you haven’t addressed your finances reliably in the past.

It’s important to remember that the mixture of getting a keen unfavorable credit score being a foreign national can aid in reducing the home loan selection

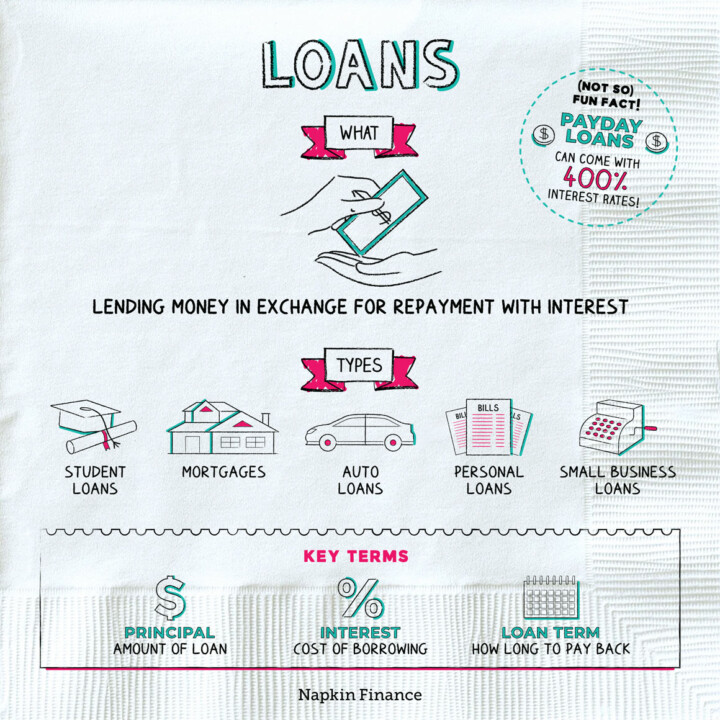

- Reputation of payday loan – Speaking of funds you might sign up for to last your up until the next pay check. Capable bring down your credit score because they could be seen as an indicator that your particular outgoings is actually larger than your own income