They’re aimed toward people who do not have a big advance payment otherwise with less-than-excellent credit. Consumers having credit scores out-of 580 or more meet the requirements. Down payment standards is actually as little as step three.5%. This new downside which have delivering a keen FHA loan is that you should have to blow financial insurance fees upfront and with each payment per month.

Va Finance

The Department of Veterans Things (VA) promises a fraction of Va finance so you can eligible veterans, solution participants, in addition to their spouses. New finance try issued of the individual loan providers. There are many pros for those who be considered, in addition to aggressive interest rates (some even on 0%), zero financial insurance rates needs, and no downpayment otherwise minimum credit score conditions.

USDA Finance

USDA financing are issued or insured by U.S. Agency of Agriculture. Such mortgages are designed to bring home buying in the rural parts. USDA finance has favorable interest rates and will be used aside https://availableloan.net/loans/single-payment-loans no currency down. Consumers need certainly to see lower-earnings qualification, and although there isn’t any credit history requisite of the USDA, most loan providers favor the very least credit history out-of 640.

Most other Financial Conditions To know

- Conforming compared to. non-compliant money: Most mortgage loans is actually compliant finance. It conform to mortgage proportions constraints put by the Government Housing Financing Service (FHFA), and additionally most regulations based by the Fannie mae and you will Freddie Mac, the two authorities-backed organizations one purchase mortgage loans off loan providers. A low-compliant mortgage does not realize authorities mortgage restrictions and you will statutes. Mortgage brokers which might be over the 2022 compliant loan restrict out of $647,200 is noticed non-compliant, with conditions made for fund taken in large-costs areas.

- Antique against. non-conventional: A normal mortgage is any financial that comes out-of an exclusive financial as opposed to a national-backed loan system. A non-conventional mortgage is a federal government-supported loan, such as for example an enthusiastic FHA or an effective Va loan.

How exactly to Qualify and implement

The mortgage application techniques may take months to accomplish, starting with making sure your money and you may credit fulfill lowest bank standards. Then you may start contrasting the many loan apps and you can evaluating mortgage lenders to obtain a loan that suits your position.

Preapproval

You might request an excellent preapproval letter once you find a potential lender. The page will state maximum amount borrowed you might be eligible for. Are preapproved facilitate show manufacturers that you will be a life threatening home consumer, however it does not always mean your going to discovered an actual loan.

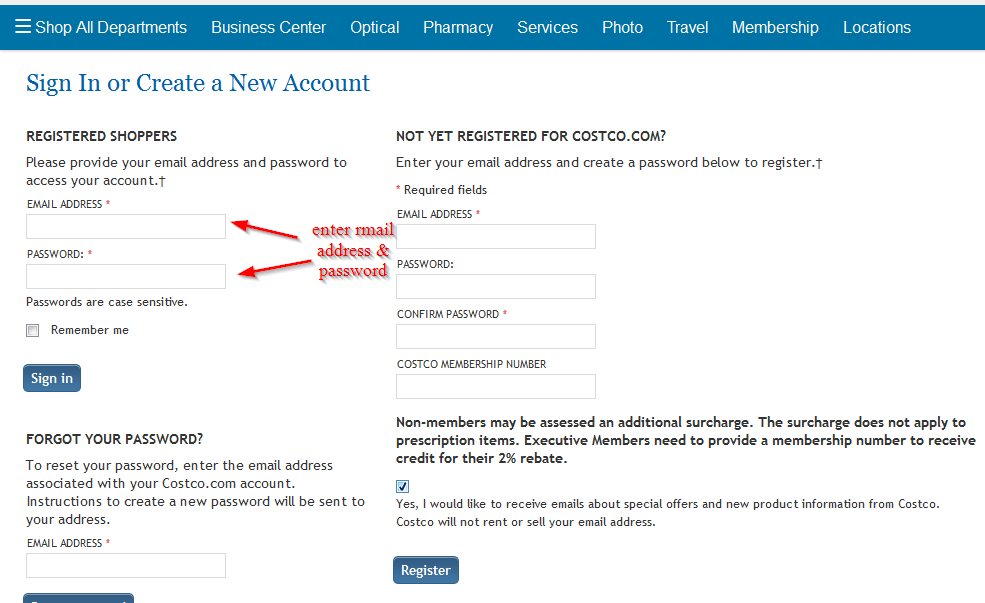

The program

You can begin your house loan application processes after you have discover a house and have now wanted to a sales rate into the supplier. Be prepared to fill out paperwork, in addition to pictures ID, W-dos forms, their past tax get back (or a couple of), pay stubs, lender comments, business comments, or other earnings and resource verification.

Underwriting

The application form tend to move into the mortgage underwriting phase adopting the bank keeps any documents. You will be requested much more information during this time period. The newest underwriter usually examine your a career history, credit, and you will funds a great deal more directly and you can assess your debt-to-earnings ratio to choose in the event that you can easily be able to pay-off the borrowed funds.

They are going to also grab other factors under consideration, just like your offers and you can assets, and exactly how the majority of a down-payment you will be and make. A home appraisal would-be bought, also a concept search making sure that here are no a good says otherwise liens up against the possessions.

The option

The lender usually sometimes approve otherwise refuse your loan demand after your software could have been examined. You could move on to brand new closing when you’re accepted to possess the mortgage.