Contents

Financial Transactions are a capital funding source from HM Treasury which can only be used to fund loans and equity investments that cross the public/private sector boundary. These have to be repaid to HM Treasury in the future through adjustments to baseline funding. A repayment profile has been agreed with HM Treasury which aligns receipts by the Scottish Government with repayment to HM Treasury. A simplified approach to impairment has been adopted, in accordance with IFRS 9, and measures the loss allowance for trade receivables, contract assets and lease receivables at an amount equal to lifetime expected credit losses. Cash and cash equivalents, trade receivables, short term loans, accrued income relating to EU funding, amounts receivable and shares will be classified as amortised cost. This will also include investment funds managed by third parties which will be reported separately.

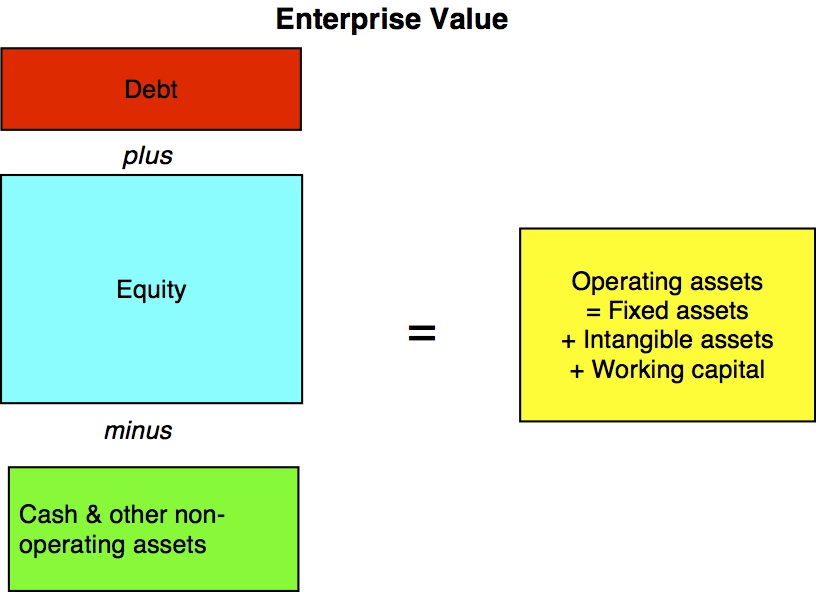

What are the 4 types of values?

The four types of value include: functional value, monetary value, social value, and psychological value. The sources of value are not equally important to all consumers. How important a value is, depends on the consumer and the purchase.

Southern General Hospital – The Elderly Bed Facility contract commenced with Carillion Private Finance on 1 April 2001 for a period of 28 years. The estimated capital value at commencement of the contract was £11m. Larkfield Unit – The Day Hospital Elderly Care Facility contract commenced with Quayle Munro Ltd on 1 November 2000 for a period of 25 years. Ayrshire and Arran Ayrshire Maternity Unit – adjoined to University Crosshouse Hospital in Kilmarnock, the facility provides Area Midwifery services for in-patients, day patients, and out-patients. The 30 year contract commenced in July 2006 and will be completed in July 2036. At the end of this period, the building is available for transfer to the NHS at no additional cost.

IAS plus

Inverurie Centres – Service Concession agreements with HUB North of Scotland Ltd for occupancy of the Inverurie Health and Community Care Hub effective 23 July 2018, Fosterhill Health Centre effective 8 May 2018 and the Inverurie Health and Community Care Hub effective 23 July 2018. Under the terms of the agreement NHS Grampian have a legal commitment to occupy the buildings for a period of 25 years and will incur annual charges for occupancy, maintenance and running costs. Woodside Health Centre – Service Concession agreement with HUB North of Scotland Ltd for occupancy of Woodside Health Centre effective 28 June 2014. Forres Health Centre – Service Concession agreement with HUB North of Scotland Ltd for occupancy of Forres Health Centre effective 9 August 2014. Aberdeen Health and Community Care Village – Service Concession agreement with HUB North of Scotland Ltd for occupancy of the Aberdeen Health and Community Care Village effective 14th November 2013. Further details of the individual contracts, including estimated capital value, can be found in the individual accounts of the NHS bodies in Scotland, Scottish Prison Service and Transport Scotland.

If the non-controlling interest is held at the proportionate method, then the entire impairment is allocated to the group due to the fact that no goodwill has been attributed to the non-controlling interest. The subsidiary must hold any inventory at the lower of cost and net realisable value, but this inventory must be reflected in the consolidated statement of financial position at fair value. This will result in an increase to inventory value and a decrease in goodwill. One of the simplest methods of calculating goodwill is by subtracting the fair market value of a company’s net identifiable assets from the price paid for the acquired business. If company X is worth €350,000 in net assets or open market value but is purchased for €400,000, the difference (€50,000) would be recorded on the balance sheet as goodwill.

Grants payable or paid are recorded as expenditure in the period that the underlying event or activity giving entitlement to the grant occurs. Where necessary obligations in respect of grant schemes are recognised as liabilities. Income is analysed in Note 4 between that which, under the regime, is allowed to be offset against gross administrative costs in determining the outturn against the administration cost limit https://cryptolisting.org/ , and that operating income which is not . Financial guarantee contracts are initially recognised at fair value. Under IFRS 9, financial guarantees are subsequently measured at the higher of the initial amount, less any subsequent amortisation where appropriate or of the credit loss allowance. Shared equity loans advanced to private individuals will be reported in the ‘At fair value through profit & loss’ category.

25 Short Term Employee Benefits

The subsidiary may have internally generated intangible assets, such as internally generated brand assets, which do not meet the recognition criteria of Intangible Assets. While these cannot be capitalised in the subsidiary’s individual financial statements, they must be recognised in the consolidated statement of financial position. This will result in an increase in the value of intangible assets with a corresponding decrease in goodwill. The book value of all the assets on the target company’s balance sheet. This includes current assets, non-current assets, fixed assets, and intangible assets from the company’s most recent set of financial statements. The fair value of financial instruments is equivalent to the carrying value disclosed in the financial statements.

- It can only be recorded in the accounts when there is an actual amount that has been paid over the fair price of the company.

- The estimated capital value at the commencement of the contract was £9m and the PFI property will revert to the board at the end of the contract.

- As noted in the relevant underlying agency accounts, the open market value of these properties would be significantly lower.

- Any related payable or receivable balances are reflected in the Statement of Financial Position.

- In accounting terms, this extra value is known as ‘goodwill’ and it is considered an intangible asset.

- As the current forecasts have been prepared assuming an orderly exit from the EU, we have assessed it appropriate to continue to value the student loan book under the current basis of assumptions in place.

These relate to interest rates, foreign currency risk and housing market risks. Labour Force Survey data – to convert income percentiles to cash amounts, regarded as more reliable than cash values from BHPS due to large sample sizes. British Household Panel Survey data – used for derivation of earnings and employment models and income distributions, especially later career stage earnings and steady state models. The Scottish Government provides funding to Salix Finance Limited and the Energy Saving Trust to deliver Programmes relating to energy efficiency which include the issue of loans.

Scottish Government consolidated accounts: annual report 2019 to 2020

Separately, a break-up of the two amounts should be included either on the face of the income statement or in the notes to the financial statements. Loans made under the terms of the student loans scheme are administered by the Student Loans Company Limited, a company owned jointly by the Scottish Ministers and the Department for Education. These loans are accounted for on the basis of the egc crypto coin loan balances of students domiciled in Scotland and adjusted for fair value and impairment. The loans issued and reported as Financial Assets within these accounts have been valued reflecting current market expectations regarding discounted future cash flows. Under IFRS 13, these valuations have been classed as level 3 unobservable inputs, as there is no active market for the investments.

What are the 10 basic values?

Schwartz and colleagues have theorized and shown empirical support for the existence of 10 basic individual values (Schwartz, 1992; Schwartz and Boehnke, 2004). These are: Conformity, Tradition, Security, Power, Achievement, Hedonism, Stimulation, Self-Direction, Universalism, and Benevolence.

These schemes operate in accordance with Scottish Government policy on revaluation as set out in Note 1.3 to these accounts. As a result of the FLMSA all of the functions previously covered by Forestry Commission Scotland , an element of the Forestry Commission , along with their assets and liabilities were transferred to Scottish Forestry, on the 1 April 2019. A liability and an expense is recognised for holiday days, holiday pay, bonuses and other short-term benefits when the employees render service that increases their entitlement to these benefits. As a result an accrual has been made for holidays earned but not taken. On consolidation into the Scottish Government accounts, the Scottish Government’s CNORIS provision represents the national scheme liability. Expenditure reported within Portfolio Outturn Statements includes grant in aid to bodies sponsored by the Scottish Government, which covers pension related expenditure in respect of pension schemes operated by the sponsored body for their eligible employees.

Receivables and Other Assets

For example, an asset has been purchased at $20,000 and has accumulated depreciation of $9,000. Entities with property, plant and equipment stated at revalued amounts are also required to make disclosures under IFRS 13 Fair Value Measurement. Functions under the Energy Act 2016 in relation to decommissioning offshore renewable energy installations in Scottish waters transferred to Scottish Ministers on 1st April 2017. This also means that the Scottish Government is now the funder of last resort in cases where the developers/owners cannot meet their decommissioning obligations.

The Board has one contract financed under a Public Finance Initiative and one under the Non Profit Distributing . Indemnity clause in roads contracts to compensate Network Rail for any damage or loss of access. Guarantees for 10 local government pension schemes, as a result of Visit Scotland taking on the staff from the local area tourist boards. The Scottish Government has underwritten the Abellio ScotRail and Serco Caledonian Sleeper pension funds, in line with guarantees provided to other train operators by the Department for Transport. For further details on the Forestry Grant and the Rural Priorities commitments, which arose from the Scottish Rural Development Plans, see the Scottish Forestry annual report and accounts.

Depreciation (cost and revaluation models)

Grant becomes repayable if either projects do not proceed as planned, where it is repayable immediately, or, projects are sold on privately up to 10 years from now. Timing is uncertain as to when events giving rise to the contingent asset are likely to occur. Court Custody and Prisoner Escort Service – This service concession arrangement covers a service let for 8 years with an option to extend for a further 2 years. HMP Addiewell – The contract covers the design, construction, financing and operation of HMP Addiewell. The contract start date was 1 June 2012 and the end date will be 17 May 2042, when NHS Tayside will become owners of the property.

The estimated capital value at commencement of the contract was £79m. Clackmannanshire Community Healthcare Centre – CCHC is a service concession for the development and right of use of Community Health Facilities and provision of services, including maintenance of the facility, under a Project Agreement. Services Commencement date was 18th May 2009 and the contract term ends in July 2037. At the end of the agreement the asset will revert to the ownership of the Board. Where the transaction is deemed to be ‘on balance sheet’, the substance of that contract is that the Scottish Government has a finance lease, with the asset being recognised as a fixed asset in the Scottish Government’s Statement of Financial Position. Up to the expected exit of the Transition Period in December 2020, there are extreme levels of uncertainty as to the impact any exit scenario will have on macroeconomic data, and on the student loan book.

Follow The Scottish Government

The material uncertainty created by COVID-19 is especially relevant to the valuation of Land and Buildings, and further information is available about the estimated valuations in note 7. There are many indicators of impairment including loss of customers or key personnel or material changes in technology or market conditions. If an entity decides that the goodwill is impaired, it must be written down to its recoverable amount.

What are the top 5 always important values?

- Honesty. Honesty should be the bedrock of your foundation, as it will define who you are before you even allow others to know more about you.

- Fire.

- Hard Work.

- Confidence.

- Perseverance.

[But accounting standards haven’t really come down on a decision – they give you a choice which causes confusion – lack of comparability! ] This not only creates powerful incentives for bonus-hungry bosses to push for an aggressive view; it is also very rule-bound — and the enemy of the prudent approach. Yet a change in the IFRS accounting standard the following day lopped £1 off net assets and meant all of its cash belonged to clients. Capita survived the shock — but at the cost of a £700m rescue rights issue. The hospital and services are provided under a contract between Lanarkshire Health Board and Summit Healthcare Limited, with hard and soft facilities management services being supplied under a subcontract to SERCO health Limited.