What is actually a two Wheeler Financing EMI?

Two-wheeler money is actually personal loans given by banking companies without having any guarantee such as your home, apartment, property, an such like. Two-wheeler money are usually available at fixed rates of interest where rates of interest depend on your credit score. The higher your credit score, the reduced your rate of interest and vice-versa. EMI ‘s the count determined at the time of choosing a good unsecured loan from the lender facing amount borrowed according to speed of interest and financing period.

A personal bank loan is out there on a higher rate of interest than a guaranteed mortgage due to higher risk inside when you are maybe not requested any security to make certain cost. These personal loans enables you to pay them regarding several to help you 72 months

When you take a personal loan, per EMI, that you will be necessary to shell out month-to-month, includes payment to your prominent and also the attention towards the prominent. Which, this new EMI of each personal loan are structured in different ways on foundation regarding Amount borrowed, Financing Tenure and you will Interest rate.

Two wheeler Mortgage EMI Calculator

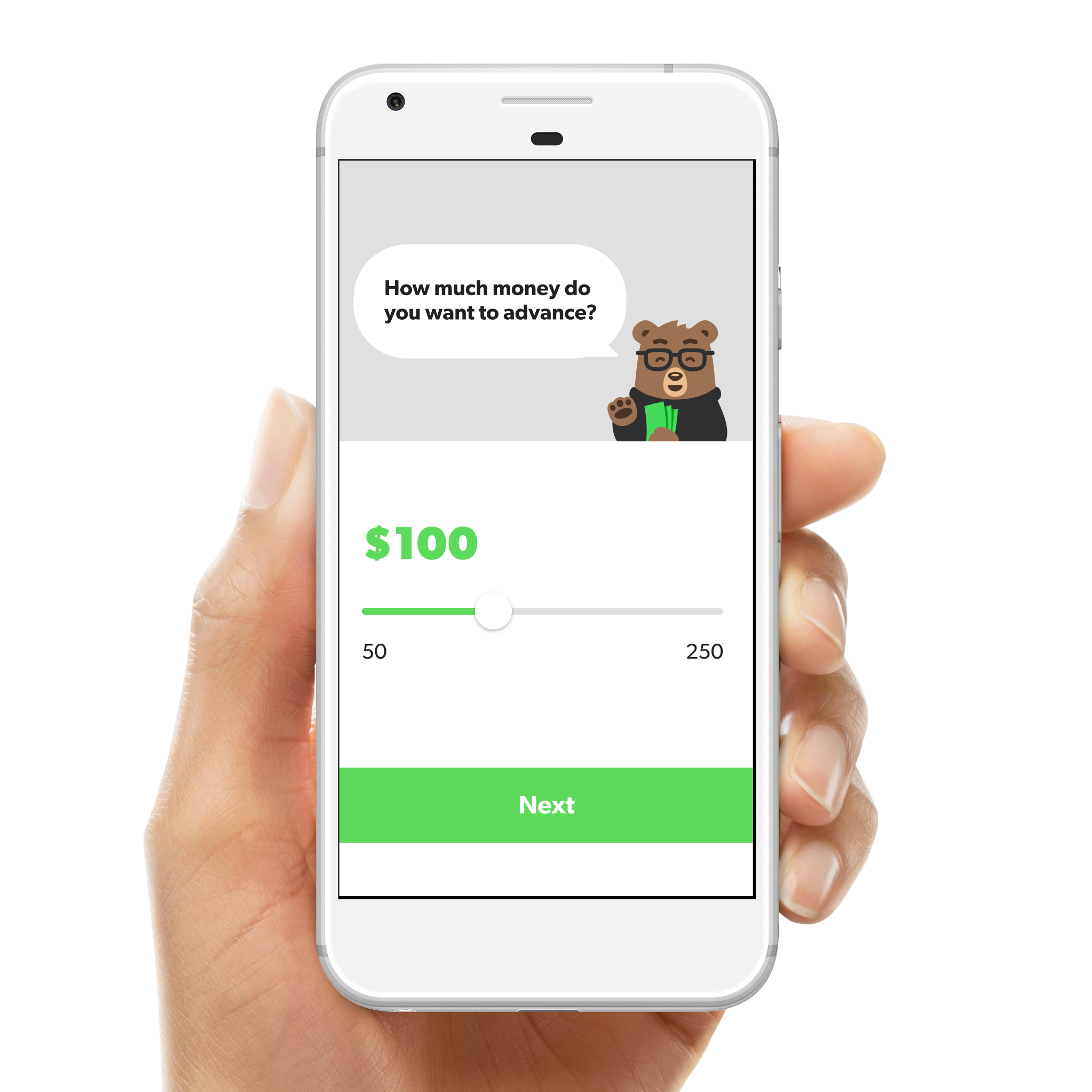

Look at the Codeforbanks web page and pick both Wheeler Financing EMI Calculator on Financial Calculator diet plan. You might be expected to help you enter in the next details: Loan amount, loan period together with rate of interest.

After you go into the three areas, brand new EMI Calculator will create the fresh new EMI amount you must pay, you eters also to locate a keen EMI option one to top serves your own considered.

Why does an enthusiastic EMI Calculator functions?

- Loan amount:Here is the original matter you to an individual borrows of a lender or any other lender. Highest the mortgage amount, the greater could be the EMI that you purchase the loan taken.

- Tenure: The newest provided period of time towards the repayment of your own mortgage. Since the fees is carried out per month, new tenure are determined in the months and never years.

- Rate of interest: Here is the price at which attract is actually recharged with the amount borrowed. The interest rate may vary towards the bank so you can bank at which you are bringing the loan.

Benefits of EMI Calculator

Even before you apply for that loan, you must know if you have the ability to see a loan. You can do this with the aid of good EMI Calculator. Figuring the EMI will let you budget ideal to make EMI repayments punctually. The other great things about the fresh new EMI Calculator become:

- Accessibility:Which on line personal bank loan calculator is accessible from anywhere away from any unit.

- Accuracy: Playing with a good EMI Calculator is more particular than figuring the newest number oneself.

- Interest rate: As previously mentioned significantly more than, EMI data should be complete before you even start your own application for the loan. A good EMI Calculator helps you using this.

- Timely Computation: Once you go into loan amount, period (in months) and you may interest, they quickly computes this new EMI into a click here.

- Save your time: You don’t need to do all new computations oneself otherwise you aren’t necessary to go anyplace to get understand the brand new EMI number. It does display new EMI instantly.

- Amortization Dining table: it provides whole amortization desk spanning that have big date, prominent, desire and you may EMI for the entire period. It is to your month-to-month base. Imagine you’re taking period from a decade (120 weeks), the latest desk often contain the information to possess full 120 months.

Issues Impacting Two-wheeler Financing EMI

Two wheeler mortgage EMI commonly connect with by several affairs whilst trust loan amount, financing period and you may interest. Any change in these types of variables often affect the EMI amount. And that, new EMI of each unsecured loan try arranged in a different way into the foundation out-of Loan amount, Loan Tenure and you may Rate of interest.